Post content & earn content mining yield

placeholder

MEVictim

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Magic Eden Airdrop: Rewards for Early Supporters and Strengthening the NFT-Centric Web3

Magic Eden rewards active users through ME Airdrops, aiming to decentralize platform governance and enhance community participation. The ME token provides users with governance rights and trading liquidity, while also supporting multi-chain NFTs to promote innovation. Although Airdrops present opportunities, they also carry market fluctuation risks. Magic Eden strives to establish a community-first benchmark in the NFT marketplace.

ME4.83%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

As a Crypto Assets observer, I must directly discuss the recent event that has sparked widespread attention—the case of Chen Zhi's 15 billion Bitcoin being confiscated by the U.S. government. This incident has raised questions for many new investors entering the crypto world: "Isn't Bitcoin supposed to emphasize Decentralization? How can it be forcibly taken over by the government?" Let's delve into the essence of this event—this is not a breach of the technological defenses, but rather a security vulnerability caused by human factors.

The truth is worth following: U.S. law enforce

The truth is worth following: U.S. law enforce

BTC-0.6%

- Reward

- 12

- 5

- Repost

- Share

ForkItAllDay :

:

This wave of assets has been played people for suckers, huh.View More

BTC Evening Thoughts:

Breaking through the previous high with strong momentum, this wave of "interest rate cut expectation bull" is about to enter an acceleration phase!

BTC is currently fluctuating around 111515. From a technical analysis and capital flow perspective, the acceleration of the main bullish trend is just around the corner!

1-hour level: The price stabilizes above the MA7 (111579) and MA30 (111020) moving averages, forming a short-term bullish arrangement; the MACD red bars continue, and the KDJ indicator still has upward momentum near 72, with the short-term adjustment being a p

Breaking through the previous high with strong momentum, this wave of "interest rate cut expectation bull" is about to enter an acceleration phase!

BTC is currently fluctuating around 111515. From a technical analysis and capital flow perspective, the acceleration of the main bullish trend is just around the corner!

1-hour level: The price stabilizes above the MA7 (111579) and MA30 (111020) moving averages, forming a short-term bullish arrangement; the MACD red bars continue, and the KDJ indicator still has upward momentum near 72, with the short-term adjustment being a p

BTC-0.6%

- Reward

- 1

- 3

- Repost

- Share

MicroscopicVivi :

:

Alright, let's check if this trend works for you tomorrow, I think everything is back on track ⬆️View More

The latest market analysis for SOL coin shows that its current price is $191.56. Although there has been a slight rise of 0.49%, there has been an outflow of funds amounting to 16.79 million, indicating signs of weakness in the pump. From a technical perspective, SOL faces a resistance level at $198 and a support level at $189. Investors should remain cautious and should not rush to get on board; it is recommended to consider entering only after the price breaks through $195.

In comparison, BNB's performance is more positive, currently quoted at 1108 USD #数字货币市场回升 with a rise of 0.67% (,

View OriginalIn comparison, BNB's performance is more positive, currently quoted at 1108 USD #数字货币市场回升 with a rise of 0.67% (,

- Reward

- 8

- 5

- Repost

- Share

MetaverseHermit :

:

sol is already dead.View More

I would like to greet all the builders, traders, and innovators who are exploring @dango. From the recent progress, the project has entered a critical phase - Testnet-3 is fully operational, which means it is smoothly moving towards the Q4 Mainnet launch.

The performance at the current stage proves that its system has achieved stability, with smooth interactions, attracting thousands of early participants, and validating the team's delivery capability in underlying execution.

From a design logic perspective, we believe that @dango is addressing the long-standing "fragmentation" issue in De

View OriginalThe performance at the current stage proves that its system has achieved stability, with smooth interactions, attracting thousands of early participants, and validating the team's delivery capability in underlying execution.

From a design logic perspective, we believe that @dango is addressing the long-standing "fragmentation" issue in De

- Reward

- like

- Comment

- Repost

- Share

#巨鲸动向 Are you curious how Liangxi can turn a 10,000 principal into 10 million? The answer lies in the rollover strategy, a trading method that was already adeptly employed by traders like Tony five years ago. He started with 50,000 and rose to 20 million within a year, becoming a well-known figure in the crypto world alongside Liangxi and Hanbalongwang.

Rollover is essentially using small funds for multiple trial and error, achieving capital multiplication through high leverage amidst market fluctuations. It sounds exciting, but its core lies in risk control, accurate judgment, and strict exec

View OriginalRollover is essentially using small funds for multiple trial and error, achieving capital multiplication through high leverage amidst market fluctuations. It sounds exciting, but its core lies in risk control, accurate judgment, and strict exec

- Reward

- 16

- 7

- Repost

- Share

ForkTrooper :

:

This low-level Be Played for Suckers method has been used to death.View More

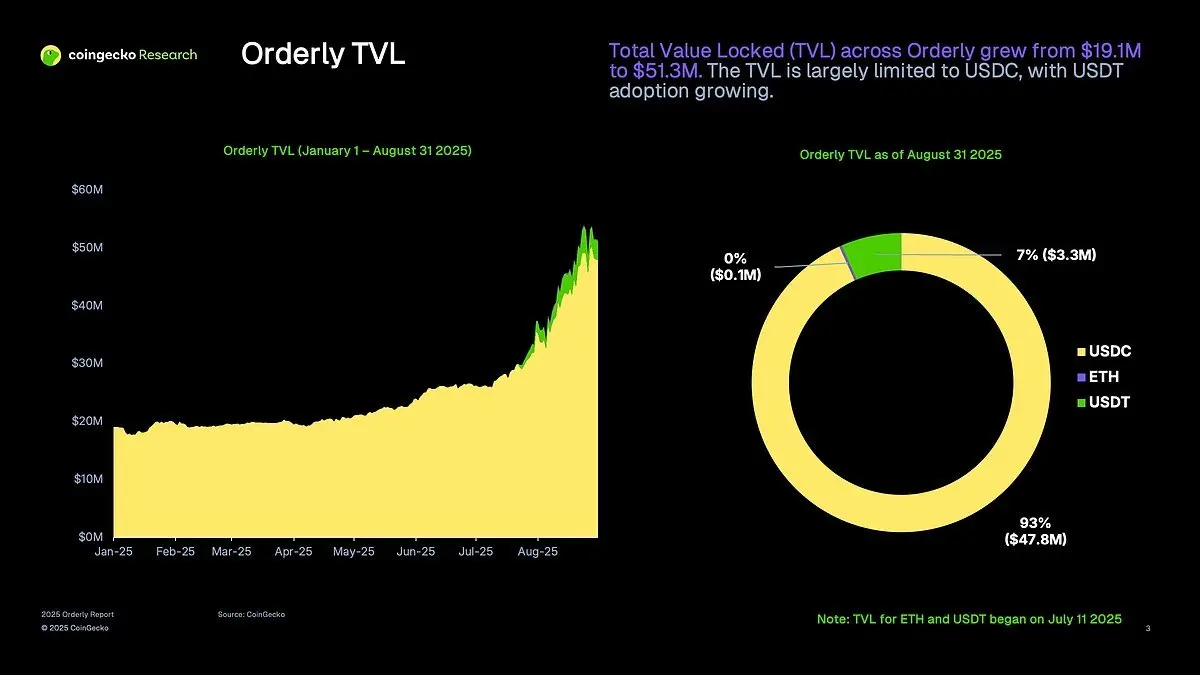

The surge in Orderly's TVL is a significant transformation behind it.

After introducing multiple collateral assets (USDT/ETH) at the end of July,

TVL surged from $19M to $51.3M in two months.

This is not the result of subsidies, but rather an upgrade of the underlying structure.

🔹 More diversified funding, no longer solely reliant on USDC

🔹 Cross-asset rebalancing has attracted institutional and quantitative players.

🔹 Opened up space for more complex derivative strategies.

This marks Orderly's evolution from a single trading pool to a self-driven mature trading layer.

The flywheel

View OriginalAfter introducing multiple collateral assets (USDT/ETH) at the end of July,

TVL surged from $19M to $51.3M in two months.

This is not the result of subsidies, but rather an upgrade of the underlying structure.

🔹 More diversified funding, no longer solely reliant on USDC

🔹 Cross-asset rebalancing has attracted institutional and quantitative players.

🔹 Opened up space for more complex derivative strategies.

This marks Orderly's evolution from a single trading pool to a self-driven mature trading layer.

The flywheel

- Reward

- 1

- 1

- Repost

- Share

0xBit :

:

Thanks for the analysis ✌️#内容挖矿升级 What has always been filtered by market fluctuations is not the amount of capital, but the cognitive level of investors. When you are struggling with questions like "should I Cut Loss?" and "should I Margin Replenishment?", the core issue may have already been overlooked by you.

The real dilemma of being trapped is not those fluctuating loss numbers, but the hesitation when facing the dilemma of "Cut Loss may lead to an increase, and Margin Replenishment may lead to a decrease." Especially in situations like now, where Bitcoin suddenly surges without warning, it becomes harder to find

View OriginalThe real dilemma of being trapped is not those fluctuating loss numbers, but the hesitation when facing the dilemma of "Cut Loss may lead to an increase, and Margin Replenishment may lead to a decrease." Especially in situations like now, where Bitcoin suddenly surges without warning, it becomes harder to find

- Reward

- 11

- 4

- Repost

- Share

HodlAndChill :

:

Got it, got it. Another old sucker who has experienced the hellish airdrop.View More

As a seasoned participant who has experienced the ups and downs of the crypto market, I started with ten thousand yuan and personally experienced the despair of nearly dropping to zero, while also achieving a hundredfold return in just ten months. After the severe tests of the market, I have summarized four crucial survival strategies.

First, focus is key: give up the temptation of diversified investment.

- Focus on 1-2 potential tracks in each market cycle.

- Focus funds on leading projects and core ecosystems

- Fully grasp the main upward trend and avoid frequently changing investment direct

View OriginalFirst, focus is key: give up the temptation of diversified investment.

- Focus on 1-2 potential tracks in each market cycle.

- Focus funds on leading projects and core ecosystems

- Fully grasp the main upward trend and avoid frequently changing investment direct

- Reward

- 14

- 4

- Repost

- Share

RegenRestorer :

:

The leveraged suckers are back.View More

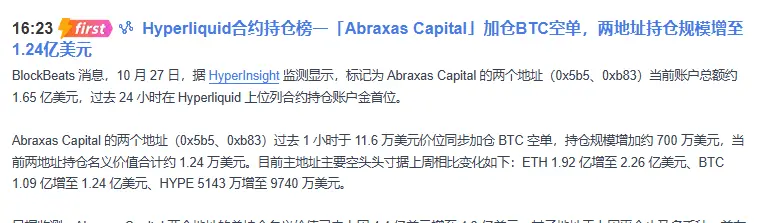

#巨鲸动向 Latest market dynamics! On the Hyperliquid contract position leaderboard, the total funds of Abraxas Capital's two accounts have approached $165 million, firmly holding the top position.

According to observations, the institution decisively increased its short positions when the price of Bitcoin reached the $116,000 range, adding approximately $7 million in a short period, bringing the total position to about $124 million. It is worth noting that they not only increased their BTC short exposure but also simultaneously raised their holdings in ETH and HYPE, expanding the overall posi

View OriginalAccording to observations, the institution decisively increased its short positions when the price of Bitcoin reached the $116,000 range, adding approximately $7 million in a short period, bringing the total position to about $124 million. It is worth noting that they not only increased their BTC short exposure but also simultaneously raised their holdings in ETH and HYPE, expanding the overall posi

- Reward

- 11

- 6

- Repost

- Share

just_another_wallet :

:

It seems that a dumping is about to happen.View More

Load More

Join 40 million users in our growing community

⚡️ Join 40 million users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

13.2K Popularity

7.6K Popularity

55.8K Popularity

67.2K Popularity

619 Popularity

- Hot Gate FunView More

- MC:$772.9KHolders:5154

- MC:$609.3KHolders:137

- MC:$466KHolders:22768

- MC:$453KHolders:10606

- MC:$75.3KHolders:189

- Pin

- 🚀 #GateNewbieVillageEpisode4 ✖️ @比特一哥

📈 Follow the trend, pick your points, wait for the signal

💬 Share your trading journey | Discuss strategies | Grow with the Gate Family

⏰ Event Date: Oct 25 04:00 – Nov 2 16:00 UTC

How to Join:

1️⃣ Follow Gate_Square + @比特一哥

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode4

3️⃣ Share your trading growth, insights, or experience

— The more genuine and insightful your post, the higher your chance to win!

🎁 Rewards

3 lucky participants → Gate X RedBull Cap + $20 Position Voucher

If delivery is unavailable, replaced with a $30 Position V - 💥 Gate Square Event: #PostToWinCGN 💥

Post original content on Gate Square related to CGN, Launchpool, or CandyDrop, and get a chance to share 1,333 CGN rewards!

📅 Event Period: Oct 24, 2025, 10:00 – Nov 4, 2025, 16:00 UTC

📌 Related Campaigns:

Launchpool 👉 https://www.gate.com/announcements/article/47771

CandyDrop 👉 https://www.gate.com/announcements/article/47763

📌 How to Participate:

1️⃣ Post original content related to CGN or one of the above campaigns (Launchpool / CandyDrop).

2️⃣ Content must be at least 80 words.

3️⃣ Add the hashtag #PostToWinCGN

4️⃣ Include a screenshot s - Are you a true GT Holder? 😎

Take a look — which one is the real GT? 💎

💰 Join the fun! 5 lucky users will each win a $10 Position Voucher!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 31, 2025, 24:00 (UTC+8) - 🎒 Gate Square “Blue & White Travel Season” Merch Challenge is here!

📸 Theme: #GateAnywhere🌍

Let’s bring Gate’s blue and white to every corner of the world.

— Open the gate, Gate Anywhere

Take your Gate merch on the go — show us where blue and white meet your life!

At the office, on the road, during a trip, or in your daily setup —

wherever you are, let Gate be part of the view 💙

💡 Creative Ideas (Any style, any format!)

Gate merch displays

Blue & white outfits

Creative logo photography

Event or travel moments

The more personal and creative your story, the more it shines ✨

✅ How to Partici