Gate Ventures Weekly Crypto Recap (October 27, 2025)

Gate Ventures

TL;DR

- The diverging performance between surging gold and stable U.S. Treasury yield showed market confidence in long-term inflation and policy stability.

- This week’s incoming data includes the FOMC decision, consumer confidence data, advance reading of US Q3 GDP, core PCE and personal income and spending data.

- Crypto markets rebounded this week: BTC +5.45%, ETH +4.38%, supported by record $446M inflows into BTC ETFs, while ETH ETFs saw $244M outflows. Sentiment turned neutral with the Fear & Greed Index at 51, and the ETH/BTC ratio slipped to 0.0366 (-0.98%).

- The total crypto market cap rose 5.3%, led by small-cap outperformance (+5.52%). The Base ecosystem gained traction amid renewed AI agent and x402 payment narratives, with $Virtual and $Clanker leading the rally.

- Among the Top 30 tokens, ZEC (+56%) surged on Grayscale’s Zcash Trust reopening, and HYPE (+28%) jumped after its affiliate filed a $1B SEC offering to acquire more tokens.

- Aave integrates Maple collateral, proposes $50M buybacks, and acquires Stable Finance.

- Coinbase rolls out AI-to-crypto interface for agentic payments infrastructure.

- Spark diversifies $100M from Treasurys into Superstate’s USCC fund for uncorrelated yield.

Macro Overview

The diverging performance between surging gold and stable US treasury yield showed market confidence in long-term inflation and policy stability.

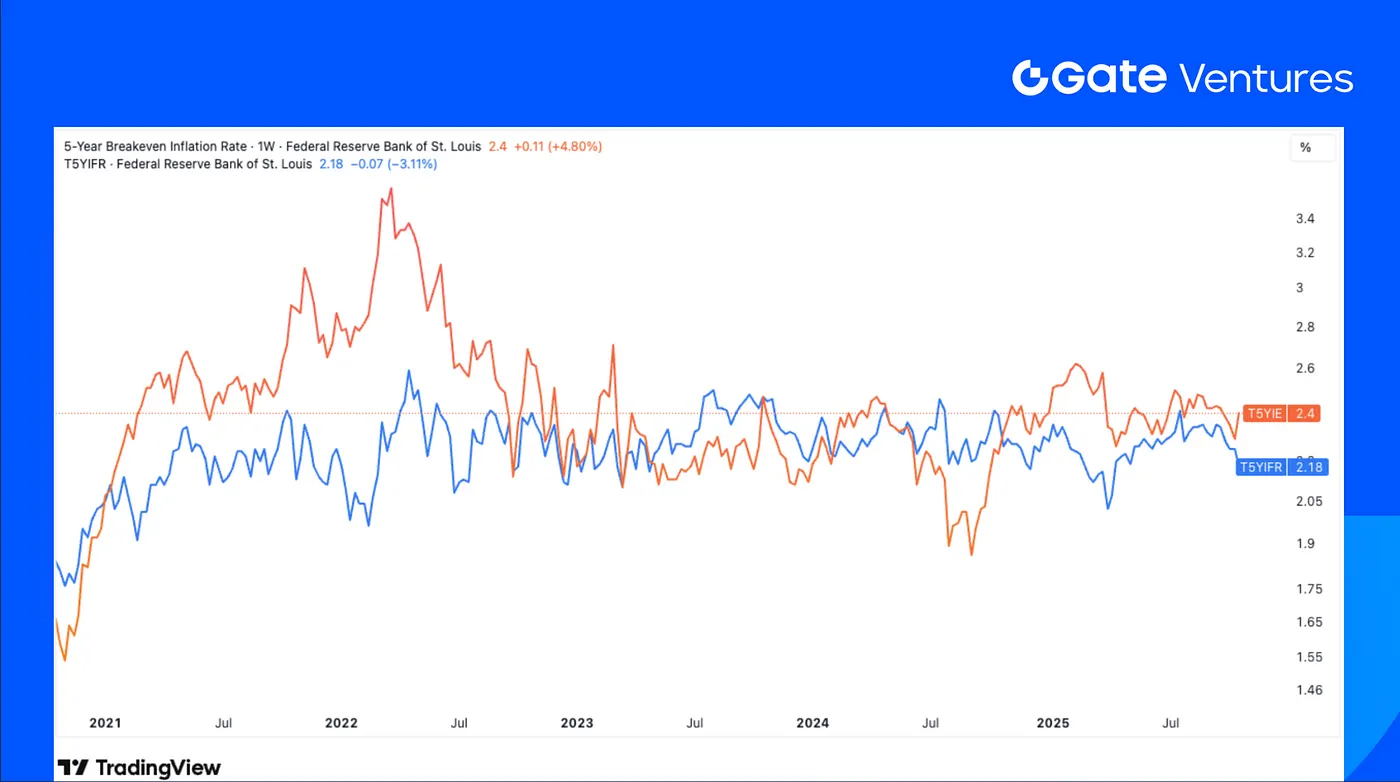

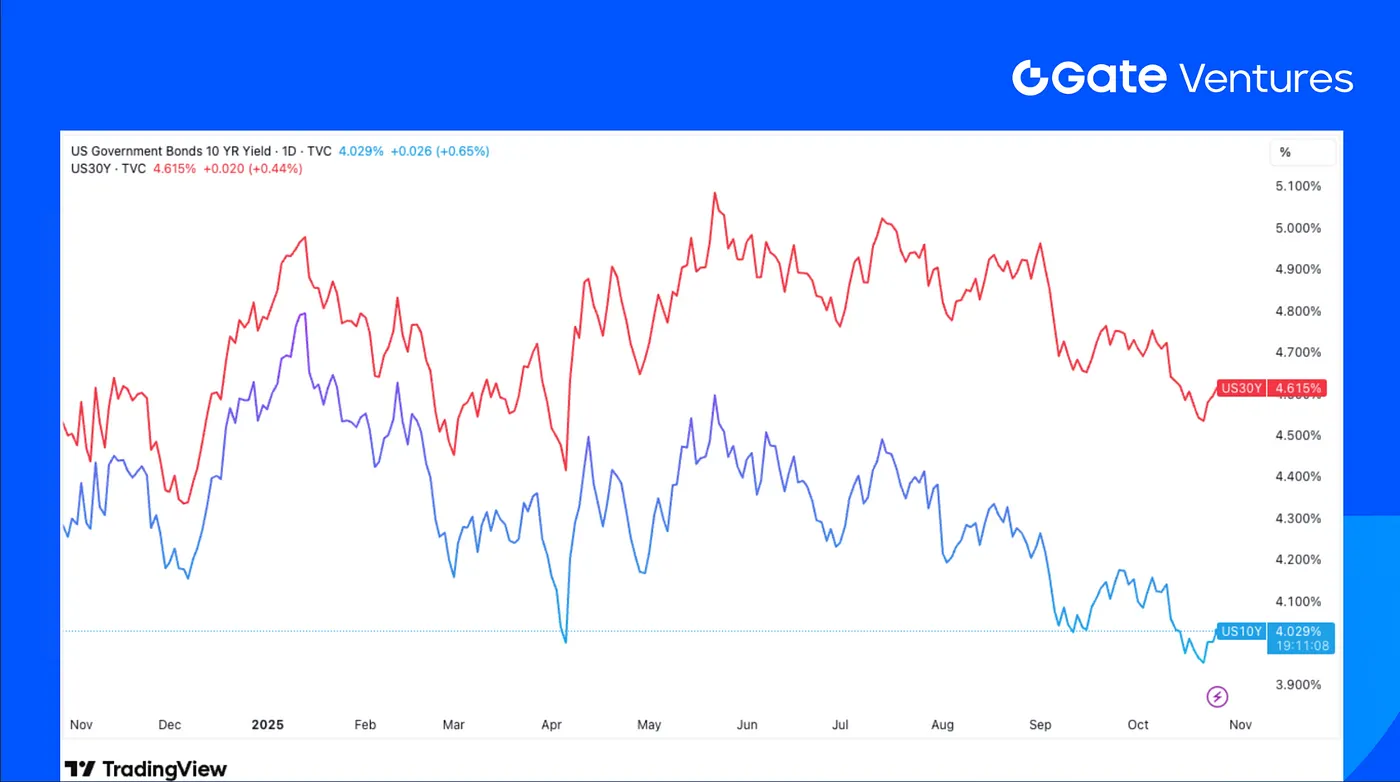

Over the past 12 months, gold prices have soared 60%, breaking its price record. Over the same period, the US dollar index against a basket of major currencies has fallen 10% from its peak and continues to trade in a low, range-bound pattern. Despite the start of the Fed’s rate-cutting cycle, the 10-year U.S. Treasury yield has not adjusted significantly, circulating around the 4.05% — 4.15% range. Key gauges of long-term inflation expectations — the 5-Year Breakeven Inflation Rate (T5YIE) and the 5-Year, 5-Year Forward Inflation Expectation Rate (T5YIFR) have remained broadly stable and close to the Fed’s 2% target, showing no volatility in response to gold’s surge.

From the perspective of asset-price dynamics, gold’s rally essentially reflects a vote of no confidence in the future credit of the US dollar. The underlying pricing assumption is that markets expect US’s elevated government debt will ultimately have to be diluted through some degree of inflation. By contrast, the performance of US Treasuries can be seen as a vote of confidence in policy credibility: their implied long-term inflation expectations remain stable, suggesting that the market currently leans toward believing the Fed can maintain its inflation target in the future, or that a potential economic slowdown will naturally restrain upward price pressures.

This week the US Federal Reserve will make a “data dependent” FOMC meeting interest rate decision, given that the official data releases were disrupted by ongoing US government shutdown. As the CPI came below market expectation, and the job market still needs more upward momentum, markets are currently fully pricing in a 25 basis point cut at the October meeting. That would take the federal funds rate to a range of 3.75% to 4.00%, its lowest since late 2022. While this week is scheduled for official release of GDP and PCE data, the gov shutdown will likely make them absent. Fed surveys in Dallas and Richmond showed the US economy is having a strong start at this quarter. (1, 2)

T5YIE and T5YIFR

DXY

The US dollar had a modest weekly gain last week, as the softer-than-expected CPI further raised market confidence in Fed’s rate cut this month.(3)

US 10-Year and 30-Year Bond Yields

The US short and long term bond yields have further seen the weakening last week, as the 10-year yield was below 4.00% on last Tuesday, clocking its lowest daily closing level in more than a year.(4)

Gold

Gold prices fell fore more than 2% last week, snapping an eight-week gain amid traders’ profit-taking. The softer-than-expected CPI stabilized gold price at around $4,100. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC gained 5.45% and ETH rose 4.38%, with spot BTC ETFs seeing record inflows of $446.36M, while ETH ETFs recorded record outflows of $243.91M. (6)

The Fear & Greed Index returned to a neutral level of 51, and the ETH/BTC ratio edged down 0.98% to 0.0366. (7)

2. Total Market Cap

Crypto Total Marketcap

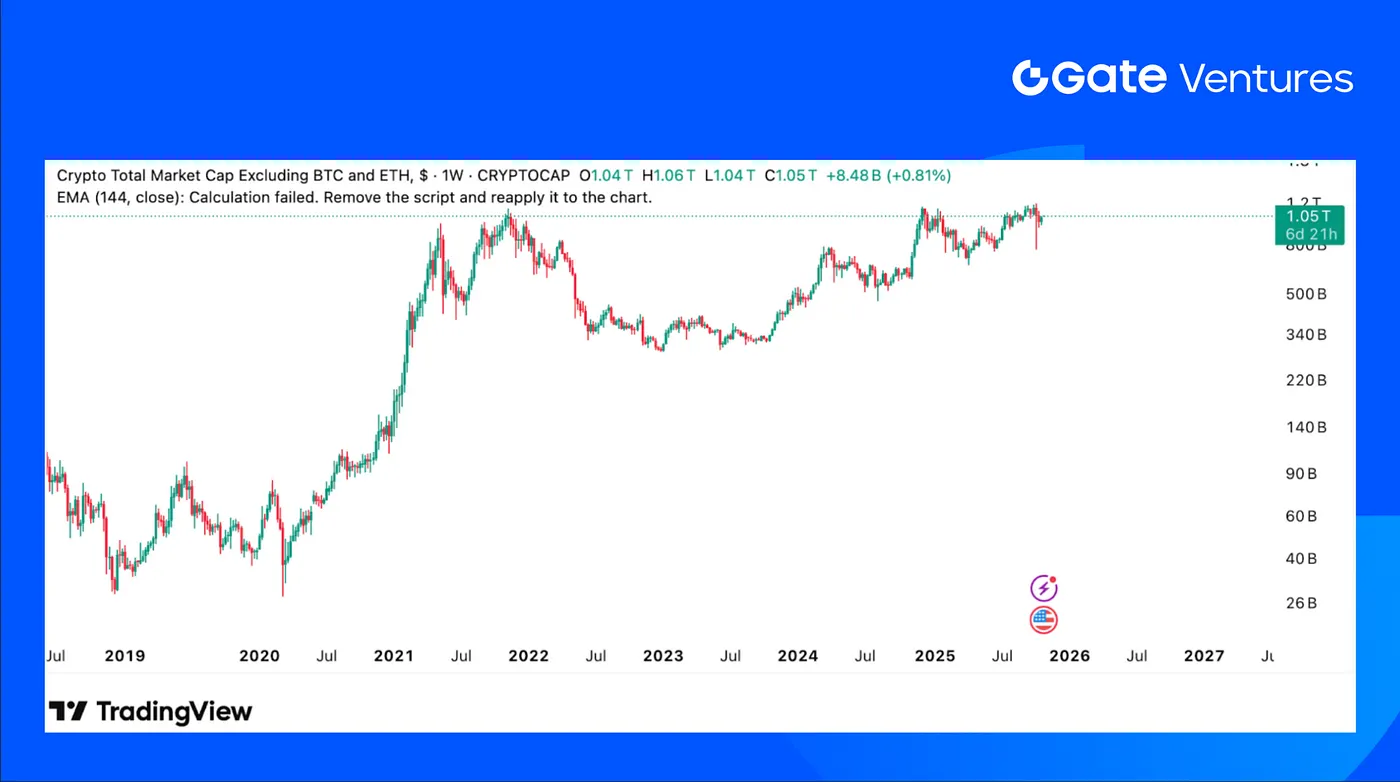

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap climbed 5.3%, while the market excluding BTC and ETH gained 4.22%. The broader market excluding top 10 tokens slightly outperformed, surging 5.52%.

Base’s ecosystem showed notable strength amid the revival of the AI agent launchpad narrative, led by tokens like $Virtual and $Clanker, alongside the emergence of new themes such as x402 payments.

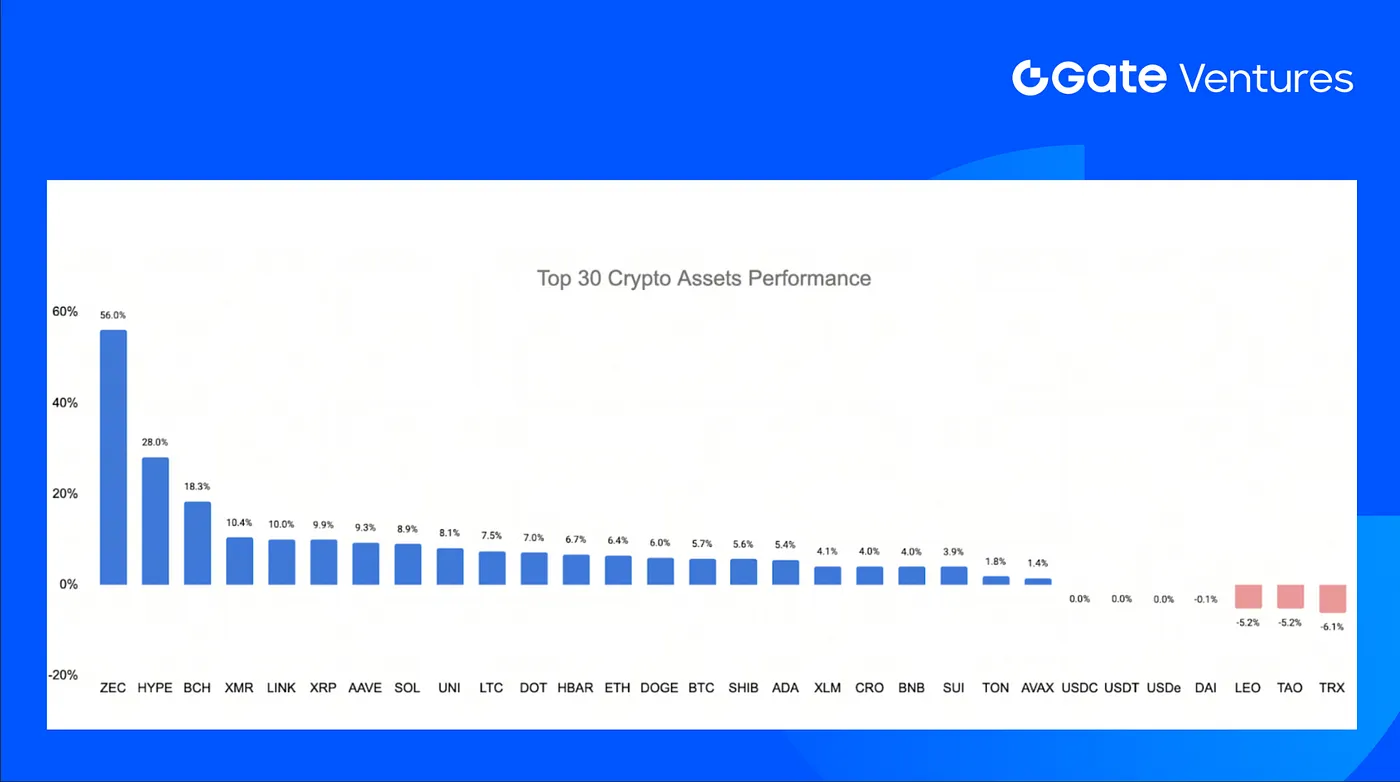

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Oct 27th 2025

The top 30 cryptocurrencies rebounded strongly from last week’s decline, led by Zcash (ZEC), Hyperliquid (HYPE), and Bitcoin Cash (BCH).

$ZEC topped the chart with a 56% weekly gain, fueled by sustained premiums as Grayscale reopened private placement subscriptions for accredited investors, expanding access to the Zcash Trust. (8)

$HYPE followed with a 28% surge, after DAT Hyperliquid Strategies Inc. filed with the SEC to raise up to $1 billion through an offering of 160 million shares to purchase additional $HYPE tokens. It also got listed on Robinhood. (9)

4. New Token Launched

Limitless (LMT) is a prediction market protocol focused on crypto price forecasts, completing a funding round backed by 1Confirmation, Coinbase Ventures, and Digital Currency Group (DCG).

The project launched with initial liquidity on Aerodrome, debuting at $0.80 before retracing to $0.34. It aims to build a decentralized, high-liquidity marketplace for event-based trading and on-chain prediction, positioning itself as a rising player in the crypto prediction market sector.

APRO Oracle (APRO) is a decentralized oracle network focused on delivering high-frequency, verifiable data feeds for on-chain applications. The project is backed by Yzi Labs, Polychain Capital, and ABCDE Capital.

APRO launched at $0.48 and is currently trading around $0.38, with listings on major exchanges including Binance and Gate. The protocol aims to enhance data reliability and latency performance for DeFi and AI-integrated smart contract ecosystems.

The Key Crypto Highlights

1. Aave integrates Maple’s yield-bearing assets, proposes annually $50M buybacks, and acquires Stable Finance

Aave advanced on multiple fronts: integrating Maple’s yield-bearing assets (starting with syrupUSDT on Plasma), proposing a $50M/year AAVE buyback funded by protocol revenue, and acquiring Stable Finance to accelerate consumer apps. The Maple tie-in targets steadier borrow demand and capital efficiency; the buyback formalizes Aavenomics; the acqui-hire widens distribution. Together, the week reinforces Aave’s position as DeFi’s leading credit hub across institutional and retail users.(10)

2. Coinbase rolls out AI-to-crypto interface for agentic payments infrastructure

Coinbase introduced Payments MCP, a system enabling AI models such as Claude and Gemini to access onchain wallets, transact in crypto, and use stablecoin payments via natural language. Built by the Coinbase Developer Platform, the tool extends the mission of the x402 Foundation, a Coinbase and Cloudflare initiative standardizing AI payments. The move underscores accelerating convergence between AI agents and decentralized finance, positioning Coinbase at the center of emerging agentic payment infrastructure where machines transact autonomously at internet speed.(11)

3. Spark diversifies $100M from Treasurys into Superstate’s USCC fund for uncorrelated yield.

Spark, the DeFi lending arm of the Sky ecosystem, allocated $100M of its stablecoin reserves to Superstate’s USCC fund, which earns yield through crypto spot-futures basis trades. The move marks the first major onchain diversification away from government securities as U.S. Treasury yields hit six-month lows. Superstate CEO Robert Leshner said the investment provides compliant, uncorrelated yield, while Spark’s Sam MacPherson noted it strengthens reserve stability as the protocol expands regulated yield exposure beyond traditional Treasury-backed products.(12)

Key Ventures Deals

1. Turtle secures $5.5M to scale its on-chain Liquidity Distribution Network

Turtle, the on-chain liquidity distribution protocol, raised an additional $5.5M from Bitscale VC, Theia, Trident Digital, SNZ Holding, GSR, FalconX, Anchorage VC, Fasanara Capital, and others, bringing total funding to $11.7M. With 358K+ connected wallets and $5.5B in liquidity routed, Turtle is emerging as Web3’s largest liquidity hub. The new capital will accelerate expansion of its Earn infrastructure and integrations, reinforcing Turtle’s role as the coordination layer for efficient, transparent liquidity deployment across ecosystems. (13)

2. Pave Bank raises $39M Series A to build the world’s first programmable, full-reserve digital asset bank

Pave Bank raised $39M in a Series A led by Accel with participation from Tether Investments, Wintermute, Quona Capital, and Helios Digital Ventures to expand its licensed banking operations in Georgia. Positioned as the first “programmable” full-reserve bank, Pave enables clients to manage fiat and digital assets in real time while automating treasury functions. The round underscores growing convergence between regulated banking and on-chain finance, with Pave targeting institutional adoption of stablecoins and programmable money.(14)

3. Hyperliquid-based Kinetiq raises $1.75M seed to expand its liquid staking and institutional DeFi products

Kinetiq, a liquid staking system backed by Maven11 Capital and Susquehanna Crypto with $1.75M in Seed round funding, was built on Hyperliquid’s HyperEVM and has exceeded $1.6B in TVL since its July debut, including $460M in first-day deposits. Its product, kHYPE, lets users stake HYPE while retaining DeFi liquidity across HyperCore and HyperEVM. By integrating products like Veda Labs’ Earn vault and iHYPE institutional tools, Kinetiq is positioning itself as a core liquidity and staking hub in the Hyperliquid DeFi ecosystem.(15)

Ventures Market Metrics

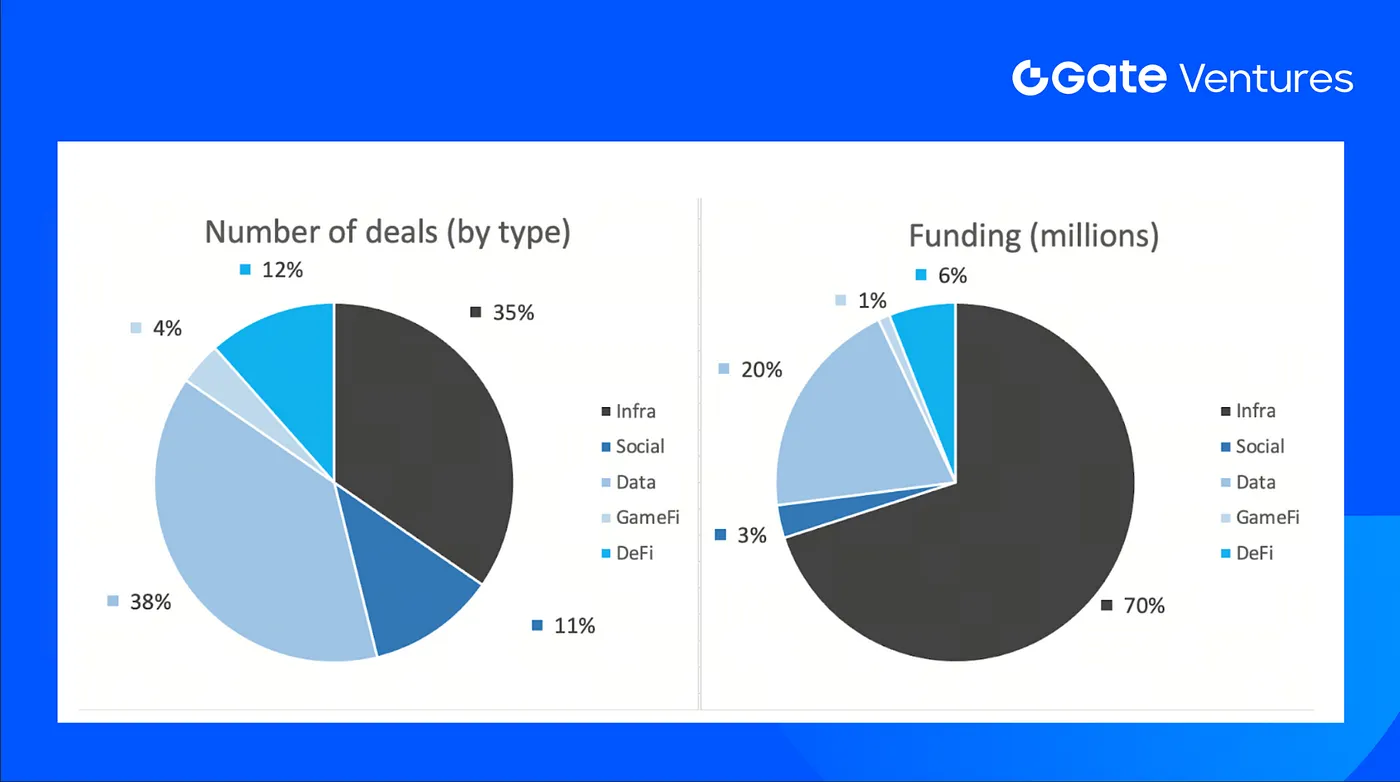

The number of deals closed in the previous week was 26, with Data having 10 deals, representing 38% for each sector of the total number of deals. Meanwhile, Infra had 9 (35%), Social had 3 (12%), Gamefi had 1 (4%) and DeFi had 3 (12%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 27th Oct 2025

The total amount of disclosed funding raised in the previous week was $288M, 8% deals (2/26) in previous week didn’t public the raised amount. The top funding came from Infra sector with $201M. Most funded deals: Pave Bank $39M, Sign $25.5M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 27th Oct 2025

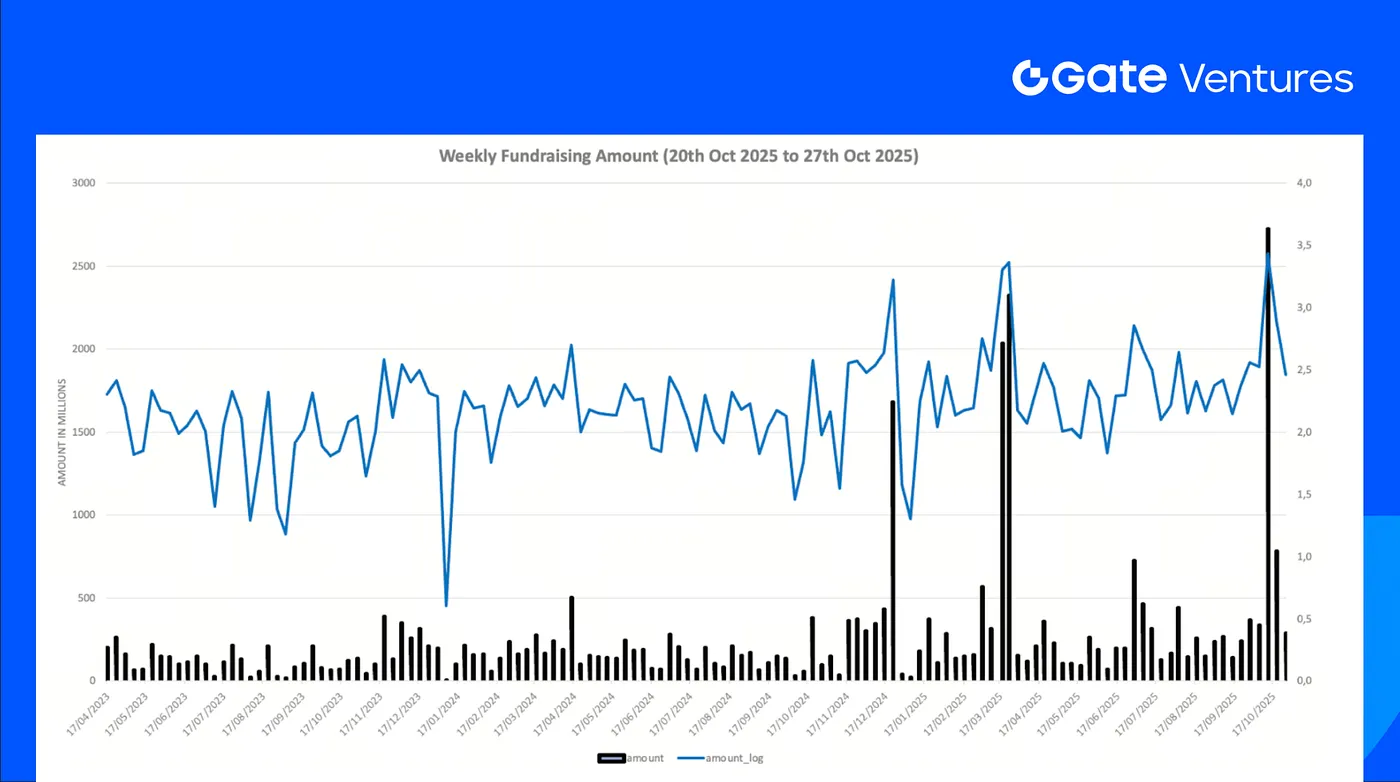

Total weekly fundraising fell to $288 for the 4th week of Oct-2025, a decrease of -63% compared to the week prior. Weekly fundraising in the previous week was up +203% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website: https://www.gate.com/ventures

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-27-october-2025.html

- T5YIE and T5YIFR, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=FRED%3AT5YIE

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Grayscale ZEC Trust, https://www.grayscale.com/funds/grayscale-zcash-trust?public

- Hyperliquid Strategies Inc. Filing, https://x.com/Cointelegraph/status/1981171405996663131

- Aave integrates Maple collateral, proposes $50M buybacks, and acquires Stable Finance, https://www.theblock.co/post/375577/largest-crypto-lending-protocol-aave-integrate-maples-yield-bearing-assets

https://www.theblock.co/post/375911/aave-labs-acqui-hires-stable-finance-team-build-consumer-friendly-defi-apps

https://www.theblock.co/post/375677/aave-dao-token-buyback-program-revenue-zeller-aci - Coinbase rolls out AI-to-crypto interface for agentic payments infrastructure,

https://www.theblock.co/post/375791/coinbase-unveils-tool-ai-agents-claude-gemini-access-crypto-wallets - Spark diversifies $100M from Treasurys into Superstate’s USCC fund for uncorrelated yield, https://www.theblock.co/post/375980/defi-lender-spark-deploys-100-million-into-superstate-fund-to-diversify-revenue-as-us-treasury-yields-dip

- Turtle secures $5.5M to scale its on-chain Liquidity Distribution Network, https://x.com/turtledotxyz/status/1980267586584543711

- Pave Bank raises $39M Series A to build the world’s first programmable, full-reserve digital asset bank, https://www.theblock.co/post/375874/tether-joins-39-million-funding-round-in-programmable-pave-bank

- Hyperliquid-based Kinetiq raises $1.75M seed to expand its liquid staking and institutional DeFi products, https://x.com/KinetiqFND/status/1981005145908392376

Thanks for your attention.

Share

Content