Building The Attention Economy

At the risk of being overly succinct, there are broadly two types of assets:

Cash Flow Assets — primarily equities and bonds. These assets generate cash flows that investors assign value to.

Supply & Demand Assets — mostly applies to commodities and forex. Prices fluctuate based on supply and demand.

Recently, crypto has instigated a new type of asset—one valued on attention. Today, “Attention Assets” are primarily user-generated assets (UGAs), like NFTs, creator coins, and memecoins. These assets act as Schelling points for, and use prices to reflect, the ebbs and flows of cultural attention.

While memecoins are interesting from a cultural perspective, they leave a lot to be desired from a financial perspective. Efficient Attention Assets should enable market participants to get financial exposure to the direct attention of something. In doing so, market participants would be incentivized to trade assets they believe are mispriced; the market could collectively produce prices that reflect predictions about attention.

We believe that, with proper construction, Attention Assets could transcend to a bonafide asset class. To help accelerate this idea, this essay proposes the idea of Attention Oracles, a new oracle construction that could enable Attention Perps—novel instruments for traders to go long or short the attention of cultural fixtures.

In short, Attention Oracles take binary prediction markets around a particular topic and use their price, liquidity, and time horizon to create a weighted aggregate index that aims to capture changes in attention. In order to function properly underlying markets must be thoughtfully chosen to represent relevant, real-world attention inputs. Using prediction markets as inputs for Attention Oracles creates an embedded manipulation cost, which would theoretically mitigate tampering because adversarial traders would need to risk capital to impact the index.

Why We Need Attention Perps

UGAs have found product-market fit in pure speculation, and are very good at tracking the attention of things that start at zero, such as new internet trends and memes.

The problem that UGAs solve is creating an asset for something that cannot exist on traditional financial rails. The traditional asset issuance process is slow, expensive and has a high regulatory bar, restricting what assets can be issued. Attention Assets must operate at Internet speed to keep pace with the global zeitgeist. The combination of permissionless tokens issuance, clever pricing mechanisms like bonding curves, and DEXs practically let anyone create an asset for free, bootstrap liquidity, and put it out into the world for anyone else to trade.

One observation of UGAs is that their prices typically start at zero. This is a feature rather than a bug because if you invent a new meme from scratch, the attention of that meme is zero at the time of creation. It intuitively makes sense that you can enter at a low price. This also allows people who are good at spotting trends early to monetize that ability by creating low-cost basis assets. However, this makes UGAs imperfect instruments for getting financial exposure to the attention of things that already exist and have lots of attention.

For example, say you want to go long the attention of LeBron James. You could create a memecoin but there are already dozens of LeBron tokens. Which one do you buy? Additionally, a new LeBron memecoin would start at close to zero but LeBron is one of the most famous people in the world. Intuitively, his attention should be extremely high and should not be able to 100x in a short period of time. Finally, what if you want to go short his attention? Memecoins would have a difficult time supporting this.

So, what would an asset for existing, high-attention topics look like?

Some requirements could include:

- It should be bidirectional so traders can go long and short

- It should be tied to some real-world source of truth for measuring attention

- It should not start at zero

If you step back and squint at these requirements you’ll quickly see that perpetual futures contracts (perps) are a great fit: they are bidirectional, have an oracle (source of truth), and are derivatives so they do not start at zero. The hard problem to solve is constructing an oracle for Attention Perps.

There are already some teams working on this problem, such as Noise. On Noise, traders can go long or short the mindshare of select crypto projects such as MegaETH and Monad. Noise uses Kaito as the oracle, which aggregates data from social media and news to generate a number that represents how much mindshare a given topic has.

However, this design could be improved. The goal of Attention Oracles is to take data related to attention as inputs, apply some function(s) to the data, and output a value for traders to go long or short.

The problem with using social media as an input is that social media is easy to manipulate. There is a version of Goodhart’s Law at play: in an adversarial market, traders will try to manipulate the inputs to price. Kaito has already had to redesign their leaderboard and anti-spam filters to address this.

Moreover, social media doesn’t capture attention in a perfect way. Let’s take Shohei Ohtani as an example. Shohei has a global fanbase that uses many disparate social media apps, which may not all be indexed by Kaito. If Shohei wins another World Series, he becomes an even bigger star, but his follower count or mentions on social media don’t necessarily increase linearly.

Attention Oracles: A Markets-Based Approach

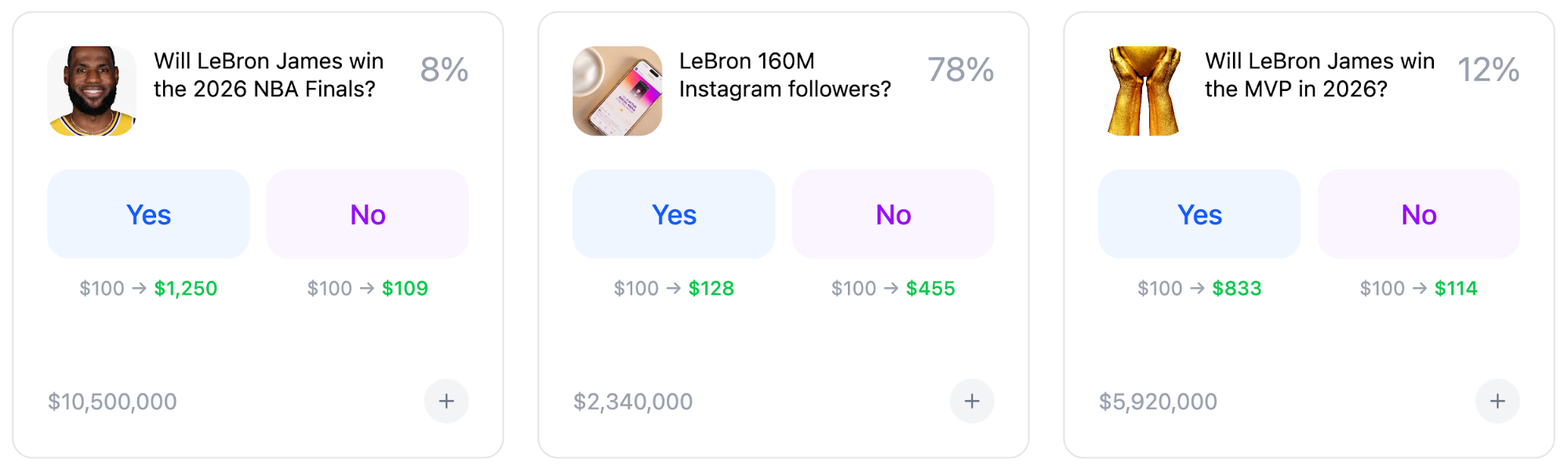

Coming back to our LeBron James example, let’s say you want to trade the attention of LeBron. To construct an Attention Oracle for him the first step would be to take in (or create if they don’t exist) many binary prediction markets for topics about LeBron, such as “Will LeBron James have over X million followers by the end of the month?”, “Will LeBron James win a championship in 2026?”, “Will LeBron James win the MVP in 2026?”, etc. A proper LeBron Attention Oracle would use many more underlying markets but for the sake of this example we will use these three. The index price is calculated through a weighted aggregation of each individual market’s price, liquidity, time to resolution, and significance.

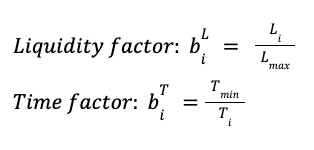

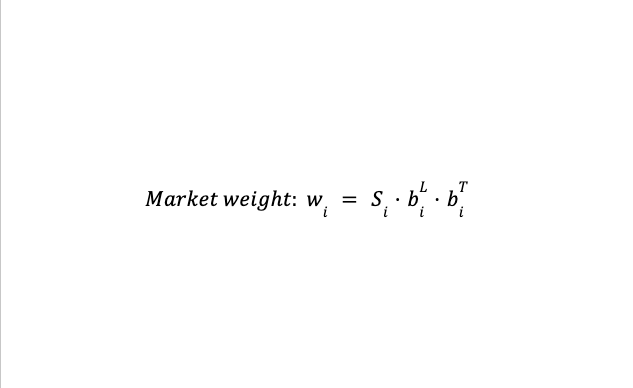

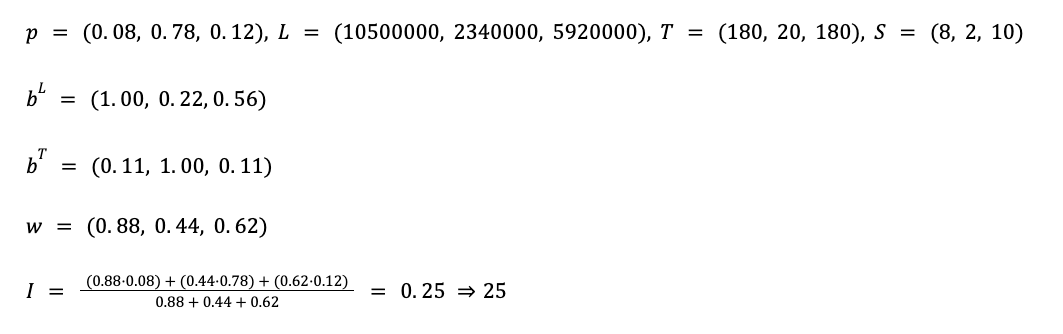

For each market, we have price, liquidity, time to resolution, and a significance score. For illustrative purposes, let’s use a very simple formula for calculating weights. Each market has a significance score from 1 to 10 along with liquidity and time factors as follows:

Let’s say we decide to score the significance of the three markets as 8, 2, and 10. The weight of each market would be:

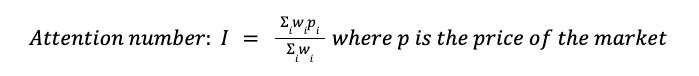

And the final attention number would be:

If we assume the time to resolution of the markets is 180, 20, and 180 days respectively, and the significance of each market is 8, 2, and 10, putting together the above would yield:

There are obviously more sophisticated ways to calculate attention metrics, such as using open interest instead of trading volume, considering correlated events, adjusting for market depth, nonlinear relationships between variables, etc. We made this interactive website for readers to create their own indices using live Kalshi markets.

The primary benefit of this prediction markets-based oracle construction is that manipulation has a material cost. If a trader is long LeBron’s attention and wants to manipulate the price to go higher, they would have to buy the underlying binary prediction market positions. Assuming sufficient liquidity in the underlying markets, this would mean buying positions at prices the market deems overpriced.

Another benefit that we think will be very important as these markets grow is that the binary prediction markets offer market makers a spot market to hedge. If a market maker is short the attention number, they can hedge their exposure by going long the underlying prediction market positions that make up the attention number.

Adjacent has created indices using live, liquid markets on Kalshi to track political trends such as Democrat vs Republican control and the NYC mayoral election. We think a similar methodology can be applied to track the attention of arbitrary topics. As prediction markets grow, the set of viable topics will expand.

The Attention Oracle Design Space

Our oracle construction does not come without tradeoffs. When thinking about Attention Oracles more broadly, we see the following as major considerations:

- How relevant are the inputs?

- How practical are the inputs to obtain?

- How manipulable/gameable are the inputs?

- What function(s) do you apply to the inputs to calculate the attention number?

The most obvious tradeoff of our proposed oracle is that the inputs are difficult to obtain. If you want to construct a LeBron James attention oracle, you must first create many different liquid prediction markets for topics related to LeBron. In addition, those markets must stay liquid over time and be replaced with liquid markets as existing ones resolve and become less relevant. Therefore, we think this design works best for a very small set of high profile topics that already have robust prediction markets around them (e.g., Donald Trump or Taylor Swift).

Another tradeoff is that attention may increase no matter how a market resolves. For example, even if LeBron does not win another ring, attention around him may increase as people question his performance. There may be heightened discussion around whether LeBron is finally getting too old or losing his touch. Similarly, attention in the real world often flows to unexpected events while a prediction market measures the expectation of an event happening. If the market expects LeBron to win MVP but he doesn’t, attention may increase while the index moves down. Fans and pundits would be discussing how LeBron was robbed or how unfairly the MVP was decided.

The best oracle designs may end up being a combination of prediction markets, social media data, and other sources. Google Trends recently opened up an alpha program for developers to access search trends data via API. Internet search volume for a topic is obviously correlated with its attention, and because Google Trends filters out duplicate searches, it may be more resistant to manipulation than metrics from social media. Another source could be using LLMs to analyze inputs that are more easily manipulated to try and filter out spam. For instance, an LLM that scores attention based on headlines across major news outlets or trending posts on X.

We believe established exchanges such as Kalshi and Polymarket are best positioned to offer Attention Perps because they already have many liquid underlying markets and users that will trade on newly listed markets. However, we don’t think the opportunity for Attention Assets is limited to the big players.

One configuration could be vaults that trade prediction markets with a mandate to be long/short a topic. For example, a long Taylor Swift vault would buy Yes contracts for events such as Top 10 song, perform at the Super Bowl, etc. It would be up to the vault manager to determine which markets are correlated with increased attention.

Another example is using Hyperliquid’s builder-deployed perpetuals. HIP-3 leaves flexibility to the market deployer in defining the oracle—an HIP-3 market could use a combination of prices on Kalshi/Polymarket, social media metrics, Google Trends, news headlines, etc.

Attention As An Asset Class

Ironically, it’s possible that the first mature application of the Attention Economy will be in the equities market. The price of a stock has two components: DCF value (i.e., intrinsic value) and memetic value.

Historically, most stocks did not have significant memetic value. But in recent years, thanks to WallStreetBets and 24x5 retail trading platforms like Robinhood, many more names have sustained memetic value.

The goal of an equities research analyst is to determine the price of a stock. There are established methods to calculate the DCF component but what about the memetic component? As more assets trade off of their memetic value, it will become necessary to develop methods to model memetic value. Sophisticated investors already use things like followers, likes, and impressions to gauge sentiment. Prediction markets, and other oracle constructions, can be useful tools to measure attention of stocks and derive better models to trade them.

But the opportunity for Attention Assets goes far beyond pricing equities. We believe that predicting attention is an economically valuable activity. Attention is a leading indicator to consumer preferences and spending. Businesses allocate R&D, hiring, and marketing dollars depending on where attention goes. It is a matter of figuring out new heuristics to model these flows.

If you’re building for Attention Assets or attention asset infrastructure, please reach out.

Disclosure: This post does not express an opinion or opine on the legality or regulatory implications in any particular jurisdiction of Attention Oracles, Attention Perps or any other products that are based on, derived from, or incorporate ideas expressed in, this post.

Disclaimer:

- This article is reprinted from [Multicoin]. All copyrights belong to the original author [Eli Qian]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?