Options Weekly Report (Oct 27) — Volatility Stabilizes Ahead of the Fed Meeting as Market Risk Appetite Recovers

Gate Options Market Performance Review

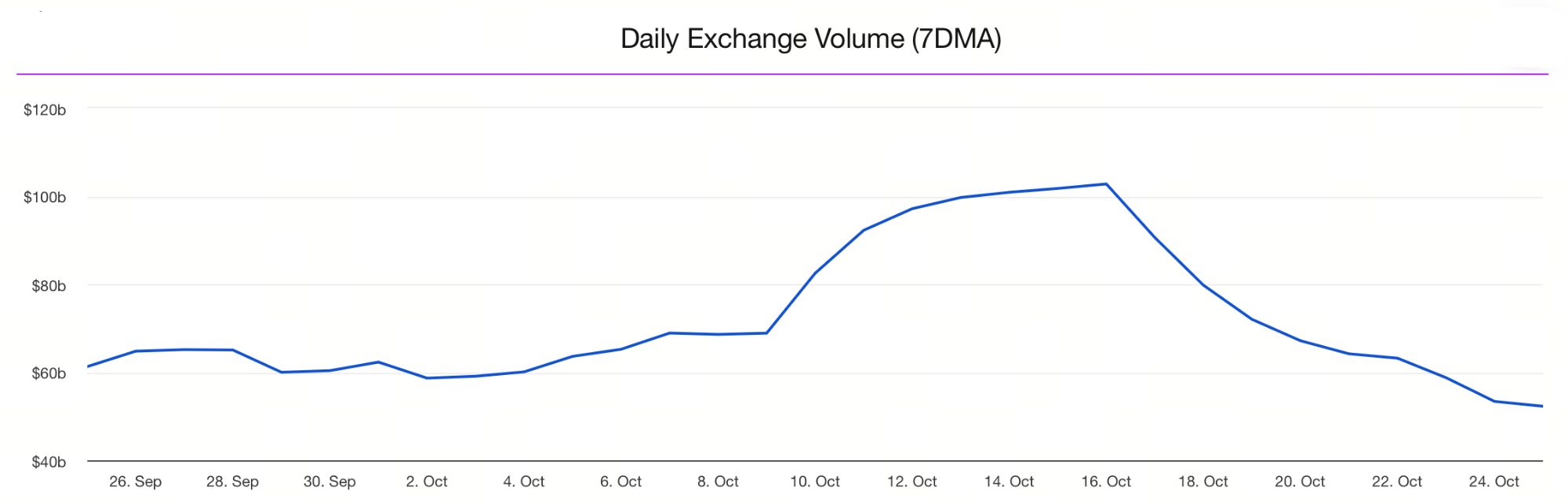

The 7-day average spot trading volume across the entire market has declined sharply for two consecutive weeks.

Bitcoin (BTC) Options Market Summary

From October 21 to October 27, the overall crypto market rebounded, supported by easing macro policy expectations and improving risk sentiment. The latest September CPI rose 3.0% year-over-year (below the forecast of 3.1%), and core inflation increased just 0.2% month-over-month, signaling continued relief in inflationary pressure. The probability of a rate cut is now estimated at 96.7%, with expectations for lower interest rates continuing to rise. The market generally anticipates a more accommodative financial environment ahead. Meanwhile, signs of easing trade tensions among major economies have reduced safe-haven demand and sparked a broad rebound in risk assets.

BTC spot market: Prices fluctuated between $108,000 and $115,000 last week. While trending higher, BTC has yet to break out decisively and remains in a consolidation phase.

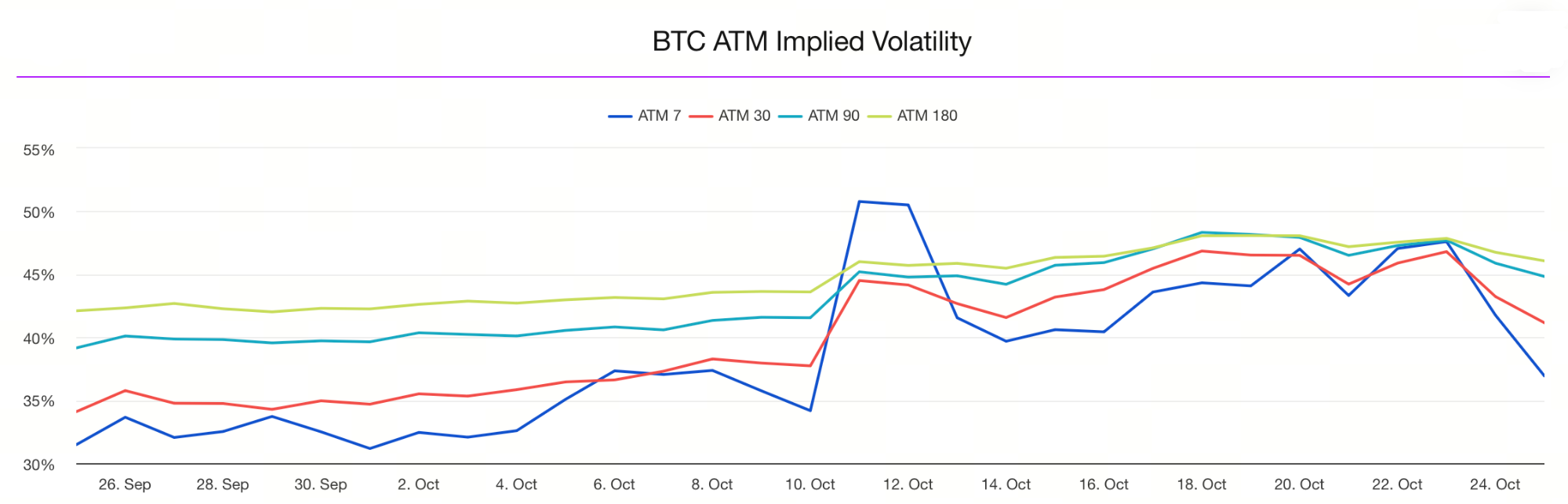

Options market: The latest BTC implied volatility (IV) stands at 42.07%, down noticeably from the previous week, indicating that market sentiment is stabilizing and expectations for future price swings are moderating.

The spread between near-term and long-term IV has normalized, suggesting the market is taking a more rational view of short-term volatility.

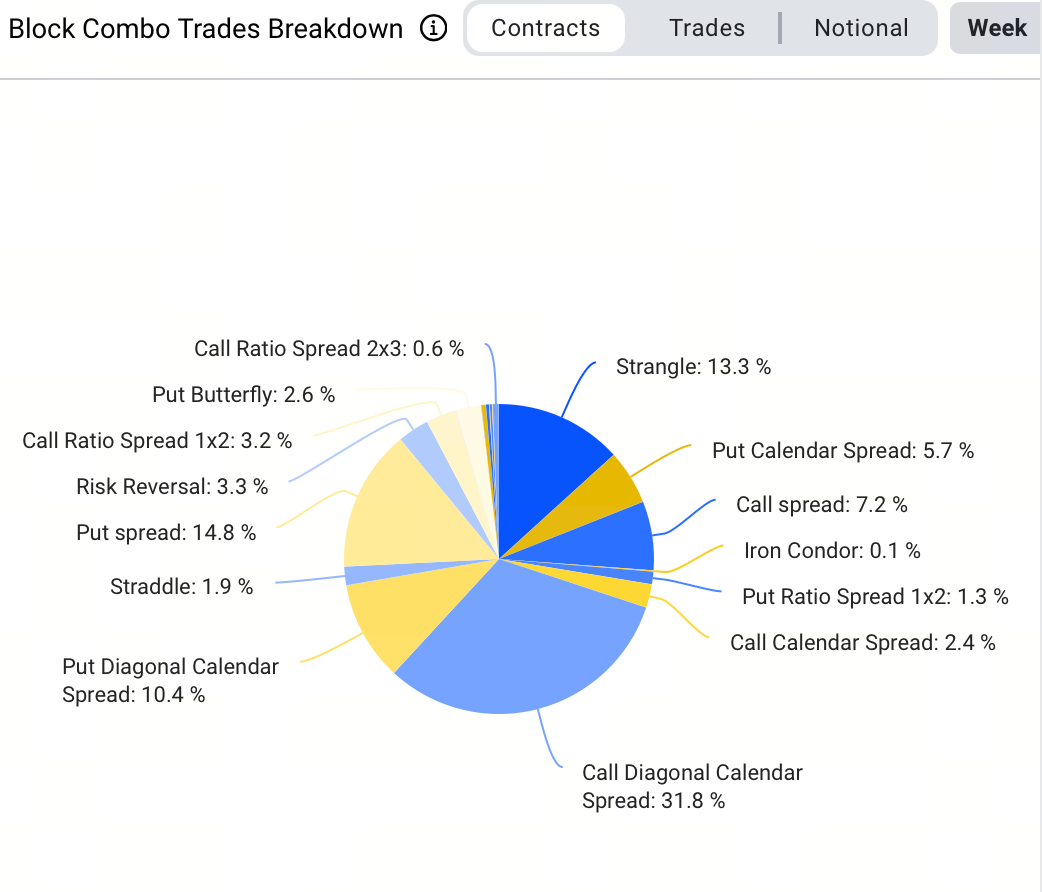

In block trading, the most popular strategy this week was the bullish calendar spread, accounting for 24.7% of volume, reflecting investors’ preference for low-cost, longer-term bullish positioning. Notably, 1,800 block trades were executed involving buying BTC-270326-180000-C and selling BTC-261225-140000-C via a bullish calendar spread.

The 25-Delta Skew for BTC options remained negative throughout the week, reflecting persistent hedging against downside risk. The options skew term structure flattened, indicating increased short-term hedging demand for rebounds. At one point, the implied volatility of puts was about 13 vol higher than calls, but this gap narrowed to around 2 vol, signaling a marked easing in bearish sentiment.

In summary, long-dated BTC options remain biased toward the downside, with institutional investors continuing to focus on risk hedging rather than betting on sharp price increases. The market remains cautious about the medium- to long-term outlook.

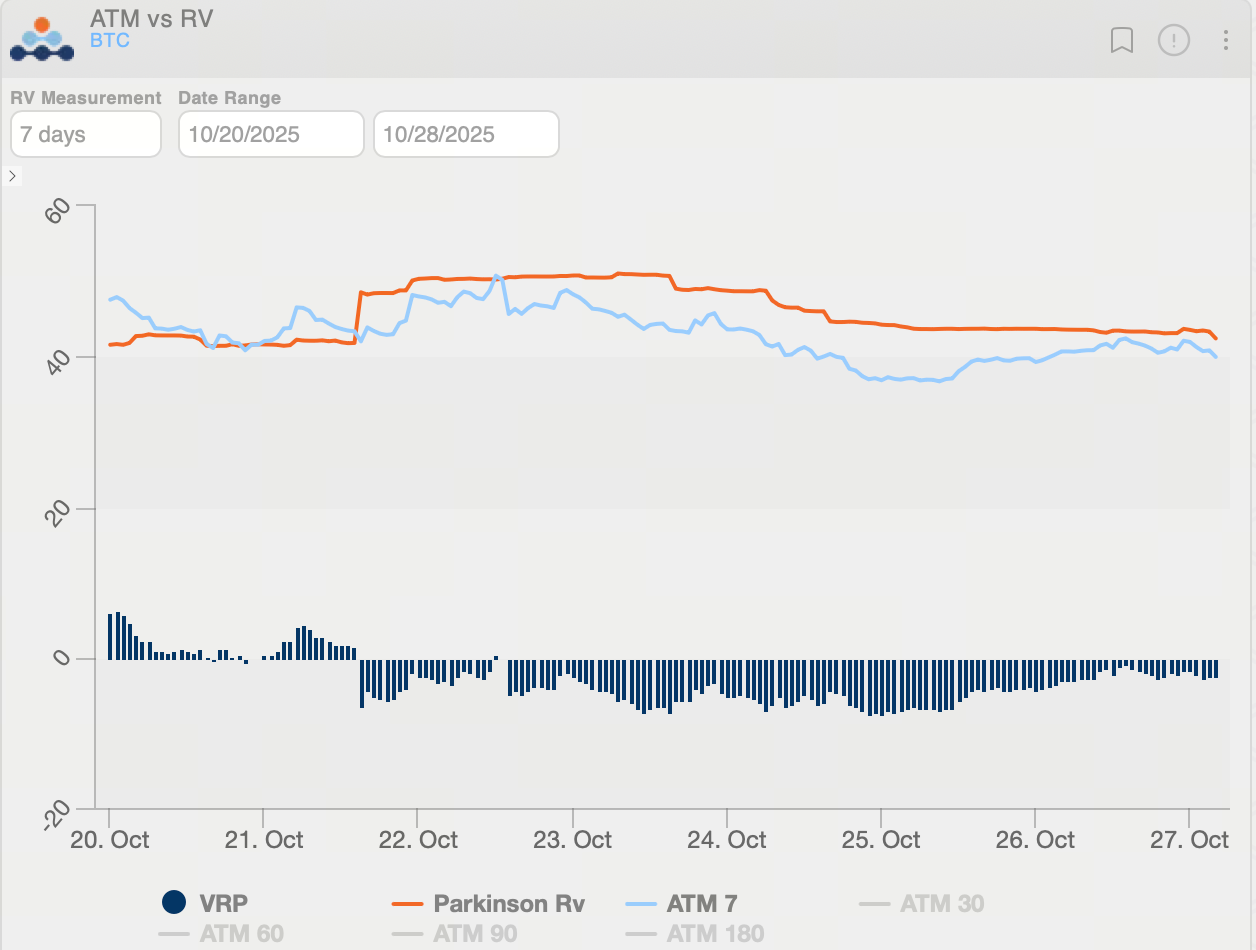

BTC realized volatility has retreated to around 40, while the volatility risk premium (VRP, IV−RV) has narrowed to -2.46 vol, a clear normalization from the -7.38 vol seen during last week’s panic. Implied volatility (IV) remains below realized volatility (RV), so VRP is still negative. In this environment, the market is pricing future volatility relatively low, making long volatility strategies—such as long straddle, long calendar spread, or other long Vega structures—attractive.

Ethereum (ETH) Options Market Summary

This week, ETH traded between $3,600 and $4,300, forming a consolidation range. Early in the week, continued selling pressure led to repeated tests of support near $3,600, but each time buyers stepped in, showing resilience. As macro risk sentiment improved, ETH rallied sharply over the weekend, briefly approaching $4,300. However, there is still notable resistance near $4,300–$4,350, and a sustained breakout will require confirmation from higher trading volumes and stronger market momentum.

Overall, ETH is in a “consolidation plus rebound attempt” phase. Short-term traders should closely monitor support at $3,600 and resistance in the $4,300–$4,350 zone.

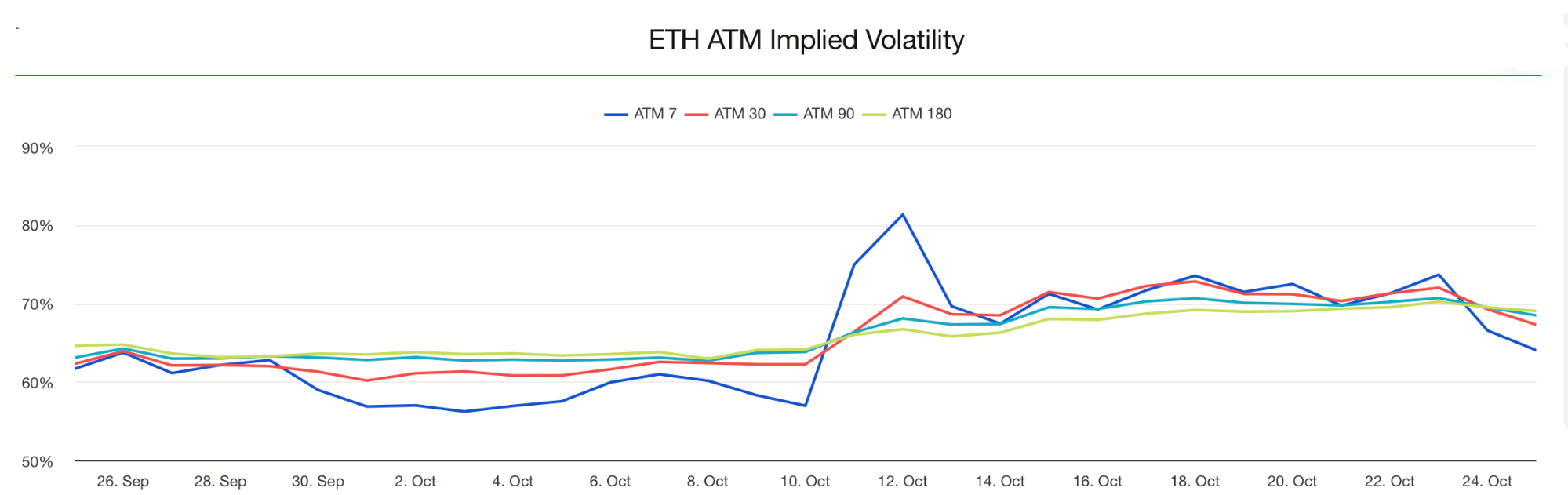

Options market: Latest public data shows ETH implied volatility (IV) at approximately 69.08%, down sharply from prior levels, reflecting steadier sentiment and lower expectations for large price swings.

The gap between near-term and long-term IV has normalized, indicating a more balanced view of short-term volatility.

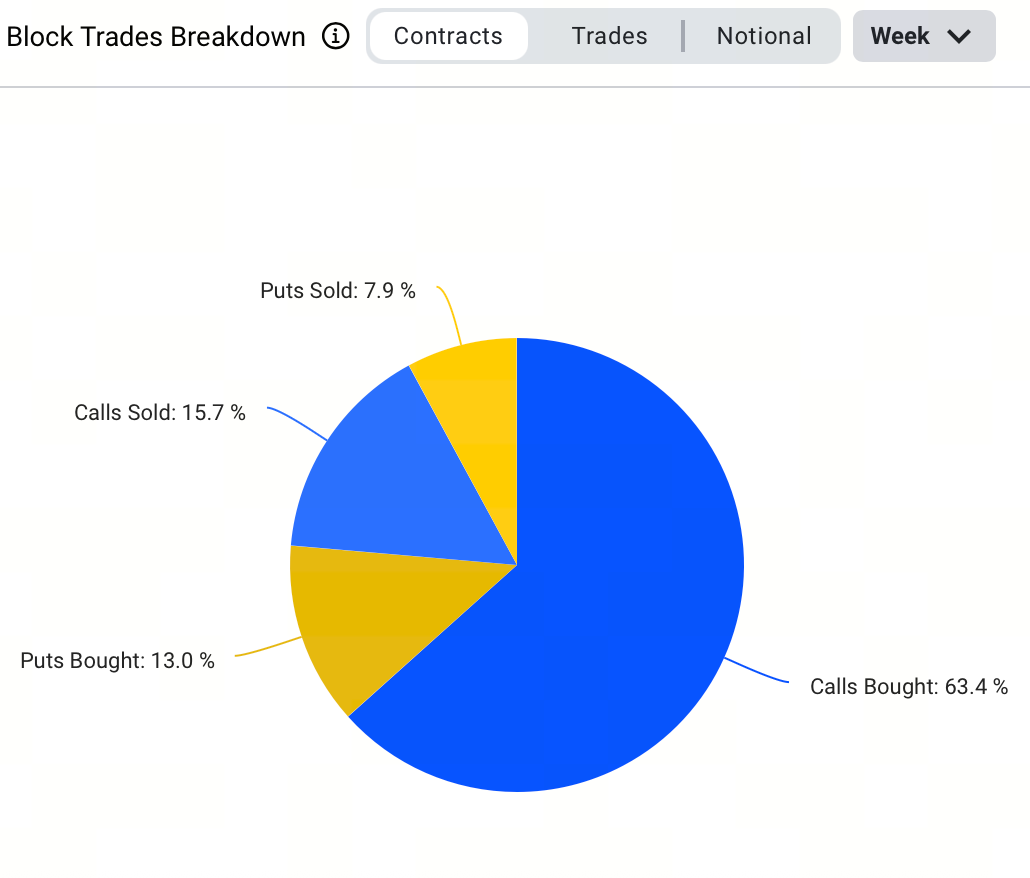

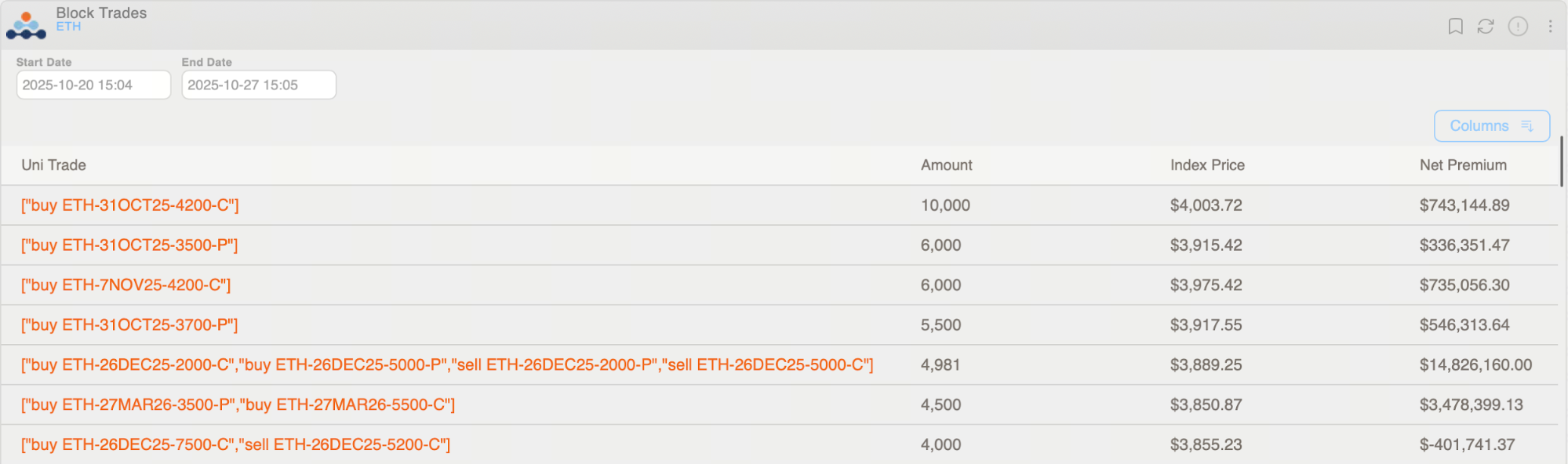

In block trading, buying call options was the dominant strategy this week, accounting for 51.5% of volume and reflecting a bullish bias. The largest single block trade was 10,000 contracts of the ETH-311025-4200-C call option.

The 25-Delta Skew for ETH options steepened midweek, reflecting increased hedging against short-term downside risk. By the weekend, the skew flattened as sentiment improved with the rebound. During this period, put implied volatility was about 15 vol higher than calls but later converged to nearly zero, indicating a significant easing in bearish sentiment.

Looking at the term structure, long-dated ETH options remain optimistic, with 2026 expiries still showing a bullish premium, suggesting medium- and long-term expectations are tilted upward.

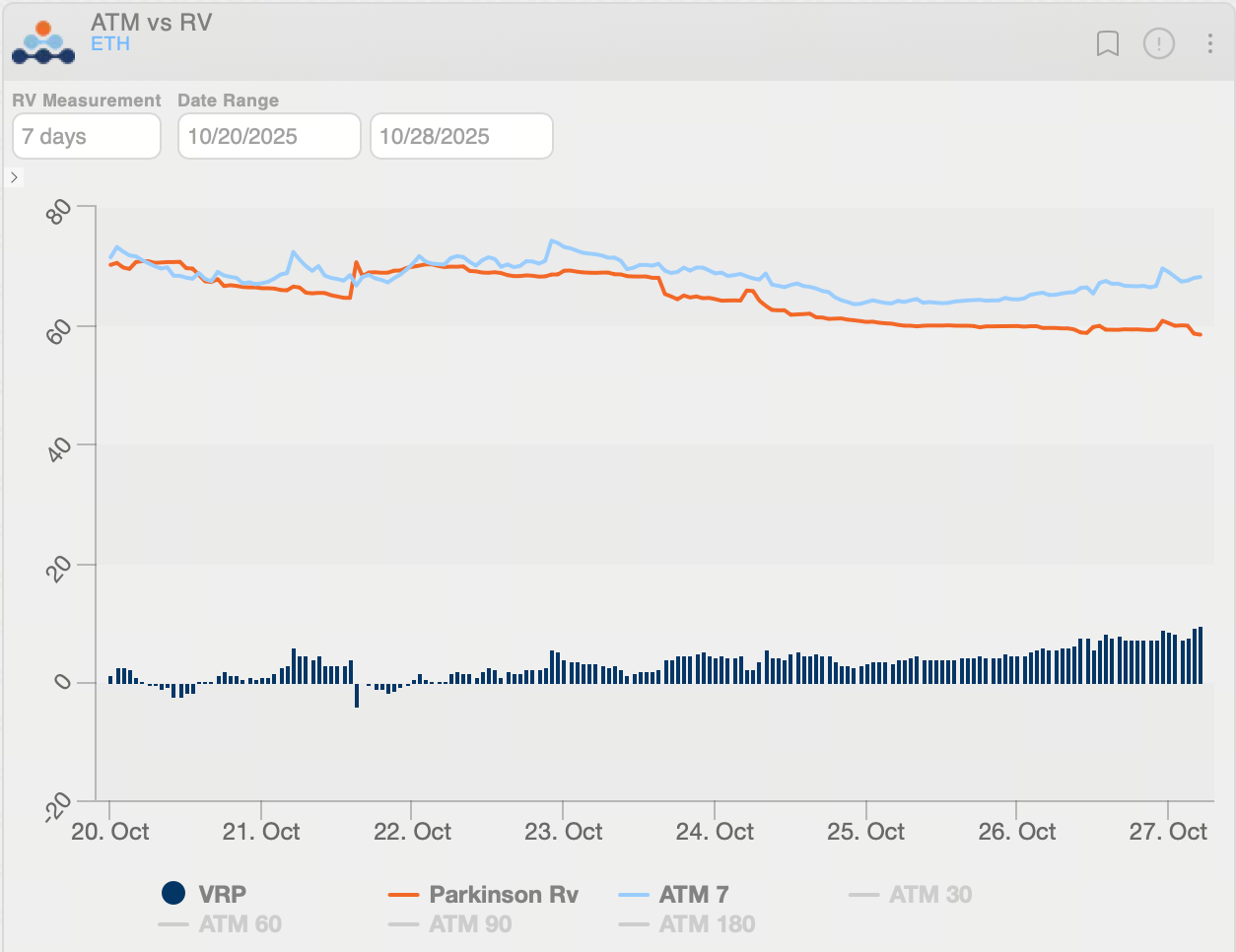

ETH realized volatility has dropped to around 58, while the volatility risk premium (VRP, IV−RV) has risen to 9.72 vol, indicating that short-term implied volatility has increased amid improving risk appetite. Implied volatility (IV) is now higher than realized volatility (RV), so the market is pricing in higher future volatility. In this context, volatility-selling strategies—such as collecting Theta by selling options or establishing short Vega positions—are relatively advantageous.

Policy Events and Market Impact Overview

- Easing China-US Trade Tensions Boost Market Sentiment

As of October 26, 2025, China-US-Malaysia trade negotiations have eased concerns over trade frictions, lifted risk appetite, and driven Bitcoin to briefly rebound above $115,000 during the week. - US September Consumer Price Index (CPI)

The US September CPI came in slightly below expectations, strengthening the market’s forecast for a 25 basis point Fed rate cut in October and fueling a short-term rebound in Bitcoin as capital rotated back into risk assets. - Federal Reserve October FOMC Meeting

The Federal Reserve’s October 28–29 FOMC meeting is expected to deliver a 25 basis point rate cut. If implemented, this would boost liquidity and risk appetite, providing a short-term tailwind for the crypto market.

Related Articles

SOL Price Consolidates Today Amid Market Volatility

Ethereum Price Prediction 2030: In-Depth Analysis of ETH’s Long-Term Outlook

Boost Your Crypto Yield with the Covered Call Strategy

What is Typus?

Dogecoin (DOGE) May 2025 Analysis and Outlook: Is the $1 Target Within Reach?