Predicting the Next Market Cycle: Behind Polymarket’s Boom and Opportunities for Early Players

2025 Crypto Prediction Markets Analysis

In 2025, crypto prediction markets experienced unprecedented attention driven by multiple factors. The US election cycle, artificial intelligence development, and global macroeconomic uncertainty served as catalysts, attracting investors and media. Looking back at the 2024 US presidential election, trading volumes on prediction markets soared: Polymarket’s trading volume in July 2024 increased 50-fold compared to the same period in 2023, with almost 99% of trades concentrated in presidential election-related markets. This surge stemmed not only from traditional gambling demand but also benefited from the constant stream of topics brought by policy events (such as elections, geopolitics, economic data) and technological waves (AI milestones like ChatGPT, GPT-4).

Institutional investors also bet on this trend: In October 2025, ICE, the parent company of the NYSE, announced a $2 billion investment in Polymarket, pushing its valuation to about $8 billion. Polymarket also partnered with MetaMask and Elon Musk’s X (formerly Twitter) platform to embed prediction data into social applications, further expanding its influence. Overall, as political events intensified and uncertainties increased due to AI and financial market volatility, trading demand for prediction markets surged, with data traffic and attention rising in tandem.

Source: https://x.com/wallstengine/status/1975537185458954432

The image above shows Polymarket’s banner displayed outside the New York Stock Exchange building, symbolizing traditional financial giants’ growing interest in prediction markets. The platform’s on-chain nature and information transparency advantages have allowed it to quickly gain prominence in mainstream society. Global renowned media and research institutions have also begun to reference prediction market data: research has shown that compared to traditional polling predictions, prediction markets often reflect election results more timely and accurately. However, regulatory uncertainties also add variables to the sector. In the second half of 2024, the US Commodity Futures Trading Commission (CFTC) proposed banning political event prediction trading within the US, and some members of Congress even publicly called for the abolition of such markets, putting compliance pressure on platforms relying on election traffic. Overall, against the backdrop of dual progress—on one hand, social and decentralized innovations are lowering participation barriers; on the other hand, the accelerating compliance process is attracting traditional capital—prediction markets are on the verge of explosion and gradually moving from marginal exploration to the mainstream financial stage.

Macro Background: Political Cycle, AI Wave, and Financial Volatility

The popularity of prediction markets relies on the combined effect of multiple macro factors. First is the political cycle: US presidential elections, midterm elections, and major political events in various countries bring enormous attention, providing prediction markets with massive trading topics. On the eve of the 2024 US election, trading volumes across the sector repeatedly hit new highs, with Polymarket alone reaching a monthly trading volume of $360 million, 50 times its 2023 average. During the same period, US congressional campaign spending was expected to approach $16 billion, reflecting society’s great interest and enthusiasm for political prospects. Similarly, global macroeconomic uncertainties—such as inflation, monetary policy, and geopolitical conflicts—continue to spawn related markets, attracting capital and information to converge. Secondly, artificial intelligence development: since the launch of large models like ChatGPT and GPT-4, predictions about new AI model releases or AI technological breakthroughs have become popular new topics. On prediction market platforms, users can bet on events like “When will ChatGPT-5 be released” or “Global AI regulatory policies implementation”, with their information efficiency and risk hedging functions gradually gaining attention. Lastly, financial market volatility provides additional momentum for prediction markets. During times of dramatic price fluctuations in crypto, stock markets, and other assets, investors are more inclined to use prediction markets to hedge risks or express views, rather than directly trading the volatile assets themselves. In summary, political elections, AI technological advances, and the dynamic financial landscape collectively shaped the thriving soil for prediction markets in 2025, making them a focus of capital and traffic.

Case Analysis: Polymarket Platform Mechanism and Representative Events

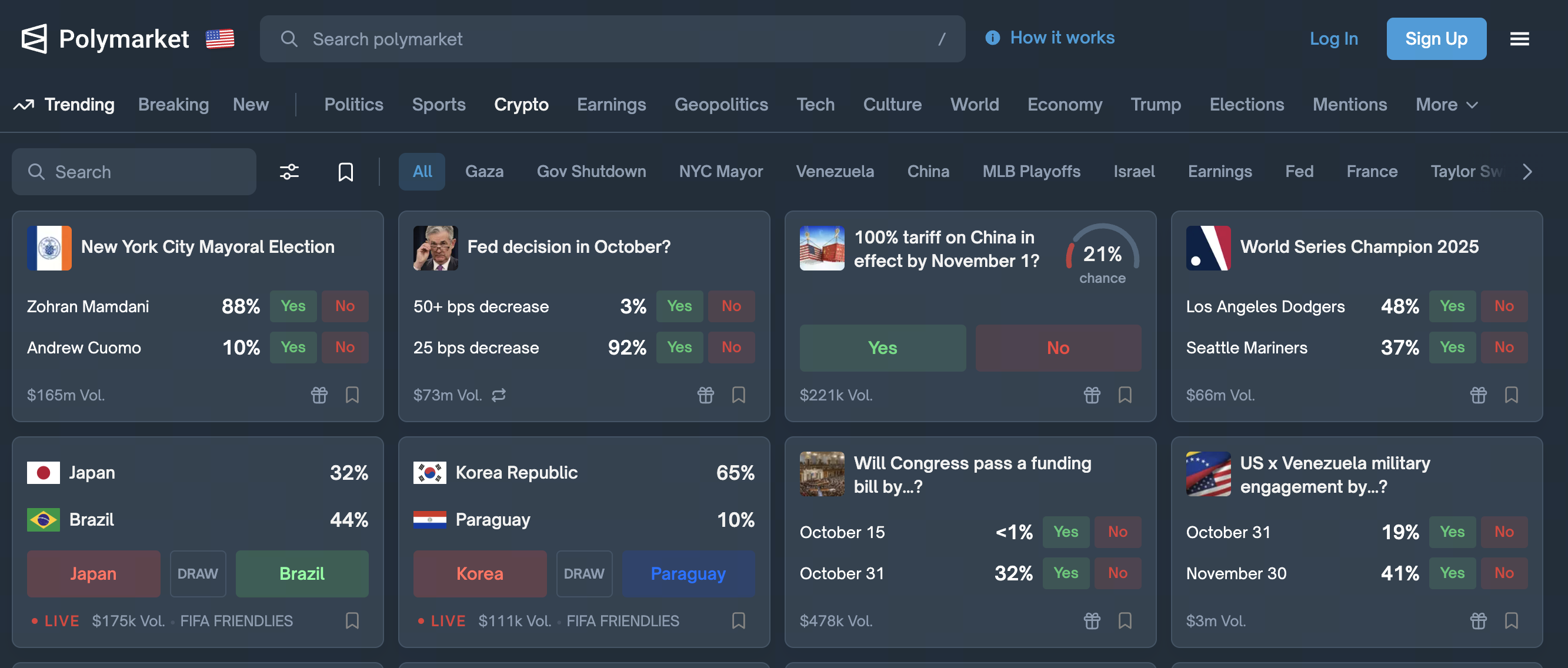

Source: https://polymarket.com/

As the largest on-chain prediction market currently, Polymarket’s platform design and typical markets are worth in-depth analysis. First is the platform mechanism: Polymarket operates on Ethereum’s Polygon chain, with all transactions settled in the stablecoin USDC. It mainly adopts a binary contract (Yes/No) model—each event market corresponds to two outcomes, “Yes” or “No”, and users can buy shares of either side until the event result is revealed. The “buy” price is the market probability of that outcome; if the price to buy “Yes” for an event is 70 cents, the market believes there’s about a 70% chance of that event occurring. To achieve efficient trading, Polymarket employs a hybrid matching mechanism: under the Central Limit Order Book (CLOB) mode, trading operations are matched off-chain and settled on-chain, where users can submit limit orders or accept market orders; meanwhile, the platform also deploys an automatic market-making function similar to AMM, ensuring tradability even in low liquidity markets. Once the predicted event result is announced, Polymarket uses UMA protocol’s optimistic oracle for settlement: if the result is disputed, UMA token holders will vote to determine the final outcome. From an incentive perspective, Polymarket charges a 2% fee on winning bets as rewards for liquidity providers. To date, the platform has distributed millions of USDC to liquidity providers to enhance market depth.

Representative event markets are emerging in abundance: presidential election-related markets are particularly prominent, such as the 2024 US presidential election and 2025 local elections in various countries, which have dominated most of Polymarket’s traffic; additionally, cryptocurrency prices are also common themes. For example, markets on Polymarket targeting Bitcoin’s price range on specific dates (see chart) show almost 100% extreme preference for Bitcoin price trends, reflecting current investors’ expectations for Bitcoin corrections; similar markets exist for other crypto assets like Ethereum and Solana (as shown in the chart for Bitcoin and Solana price range markets). Macroeconomic events such as Federal Reserve rate decisions and inflation trend forecasts are also common on the platform (such as the market for “Will the Fed cut rates in October”, currently with a 91% probability betting on a rate cut), indicating that traditional financial issues are also incorporated into the prediction scope. For social hotspots and breaking events, questions like “When will Israel declare a ceasefire” or “Who will become the first CEO of a Fortune 500 company” have also appeared on Polymarket. These diversified markets collectively demonstrate that Polymarket provides prediction tools covering numerous fields including politics, finance, technology, sports, and social culture, allowing users to choose markets to bet on based on their interests and information advantages.

Information Economic Logic: Price Discovery and Collective Wisdom

The core value of prediction markets lies in their price discovery function and mechanism for mapping collective wisdom. Economists point out that prediction markets are a kind of information aggregation mechanism, similar to the process of “prices transmitting information” described by Hayek. Specifically, each participant places bets based on the information and models they possess, buying into a result when they believe the probability of that outcome occurring is higher than the price given by the market. This process of “betting drives truth” continuously pushes market prices up or down, making prices gradually approach the true probability of event occurrence. For example, if the market currently estimates a candidate’s chances of winning at 55%, and a participant is confident that the actual probability should be 70%, they have the incentive to buy that outcome at a price lower than their estimated value, eventually pushing the price to a more reasonable level. As experts at a16z say, “The prices in prediction markets actually reflect the consensus probability of participants on the outcome,” and these prices are often more sensitive than traditional surveys. Historical data also supports this view: research from the Iowa Electronic Markets (IEM) at the University of Iowa shows that its prediction errors are far lower than traditional polls.

From a higher perspective, the prices in prediction markets actually condense the dispersed information of all participants. All participants’ experiences, models, news interpretations, and other information are “embedded” into the prices through trading behaviors, ultimately forming a more objective probability estimate than any individual viewpoint. As Hayek said, market mechanisms excel at gathering knowledge dispersed in many minds, and the amount of information prices can contain often exceeds individual cognition. This collective wisdom makes prediction markets an extremely accurate forecasting tool in many scenarios: in recent presidential elections, several prediction markets even gave signals of Trump’s possible victory earlier than polls. It’s worth noting that the characteristic of prices reflecting probabilities also brings the risk of impermanent loss: when the probability of a certain outcome is extremely biased towards 0% or 100% (price close to 0 or 1 dollar), market liquidity providers betting on the opposite outcome may suffer significant losses. Therefore, some prediction markets compensate market makers through reward mechanisms to maintain effective liquidity.

User Participation Approaches and Airdrop Opportunities

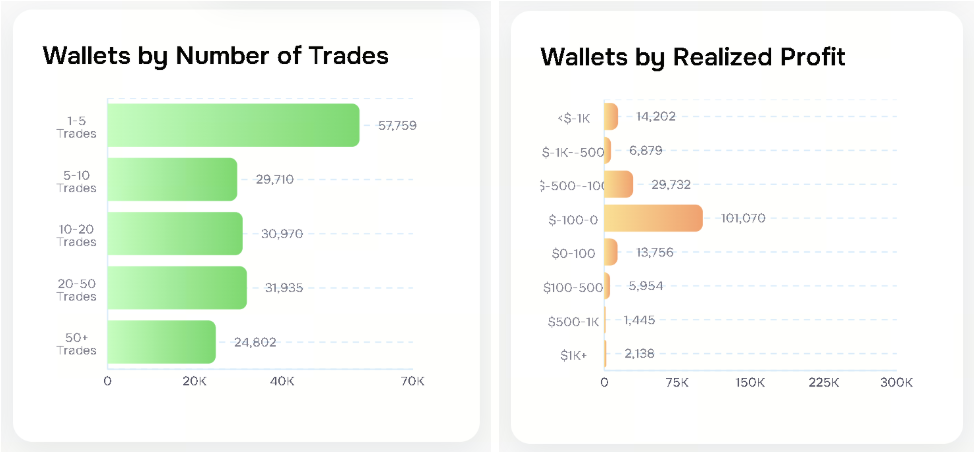

The threshold for ordinary users to participate in prediction markets is not high; as long as one has a stablecoin wallet, they can place bets or provide liquidity. Taking Polymarket as an example, users only need to connect their wallet and deposit USDC to enter any open market for buying and selling; Polymarket also supports placing orders through its central limit order book or AMM. In addition to direct trading, some prediction market platforms have launched airdrops or reward programs to attract early user participation. Rumors about Polymarket issuing a governance token {$POLY} are rampant. Analysis suggests that with Polymarket’s 1.35 million active traders, if tokens are distributed based on participation levels, its airdrop scale could surpass historical records. For instance, data analysts have found that only 0.51% of addresses on Polymarket have profits exceeding $1000, but activity levels are extremely high, meaning that if an airdrop occurs, potentially hundreds of thousands of people could be eligible. Therefore, early users currently participating in Polymarket should pay close attention to token release dynamics.

Similarly, the Azuro protocol, as a base layer, has also designed clear reward mechanisms for early users. Azuro’s community airdrop program distributes {$AZUR} tokens to participants in phases: the first round of airdrops covered over 45,600 addresses, totaling 60 million. Azuro assigns “Azuro scores” based on users’ behaviors in ecosystem applications (betting transactions, liquidity provision, bug discovery, etc.) and distributes tokens linearly according to the scores. This means that frequent betting in the Azuro ecosystem, long-term liquidity provision, and participation in community testing can significantly increase the airdrop allocation share. After obtaining tokens, users can choose to participate in staking to gain additional airdrop multipliers and future inflation rewards. Similarly, Zeitgeist, as a prediction market project in the Polkadot ecosystem, has distributed its native token {$ZTG} through early investment rounds and community rewards. Future participation in its on-chain market creation, betting, or governance voting may lead to more token benefits.

Overall, user participation approaches mainly include:

- Direct betting and trading on the platform

- Providing liquidity for markets

- Participating in platform governance and community activities

As projects develop, related tokens (such as POLY, AZUR, ZTG, etc.) are likely to be further distributed to active users through airdrops, incentive pools, staking rewards, and other methods. Therefore, users wanting to seize early opportunities should participate and interact more: betting on various popular events on Polymarket or betting and providing LP in Azuro ecosystem applications can all increase the probability of obtaining tokens in the future. Additionally, sharing prediction insights and helping discover bugs in social media and communities usually can increase “contribution levels” and gain extra rewards. It’s important to note that before participating, one must understand the rules and risks of each platform, such as Polymarket’s compliance restrictions for US users and Azuro’s snapshot times for each phase, to ensure eligibility for airdrops and safe operations.

Source: https://cointelegraph.com/news/gambling-on-polymarket-profitability-data-revealed

The above image shows the distribution of trading volume and profitability among Polymarket users based on on-chain data. Although there are many active users, as the analysis shows, only a small portion of users achieved higher returns (right chart), with the vast majority of traders even slightly losing money. This emphasizes the importance of early participation in airdrops or rewards: gaining returns through contribution rather than blind gambling will be the key strategy for long-term players.

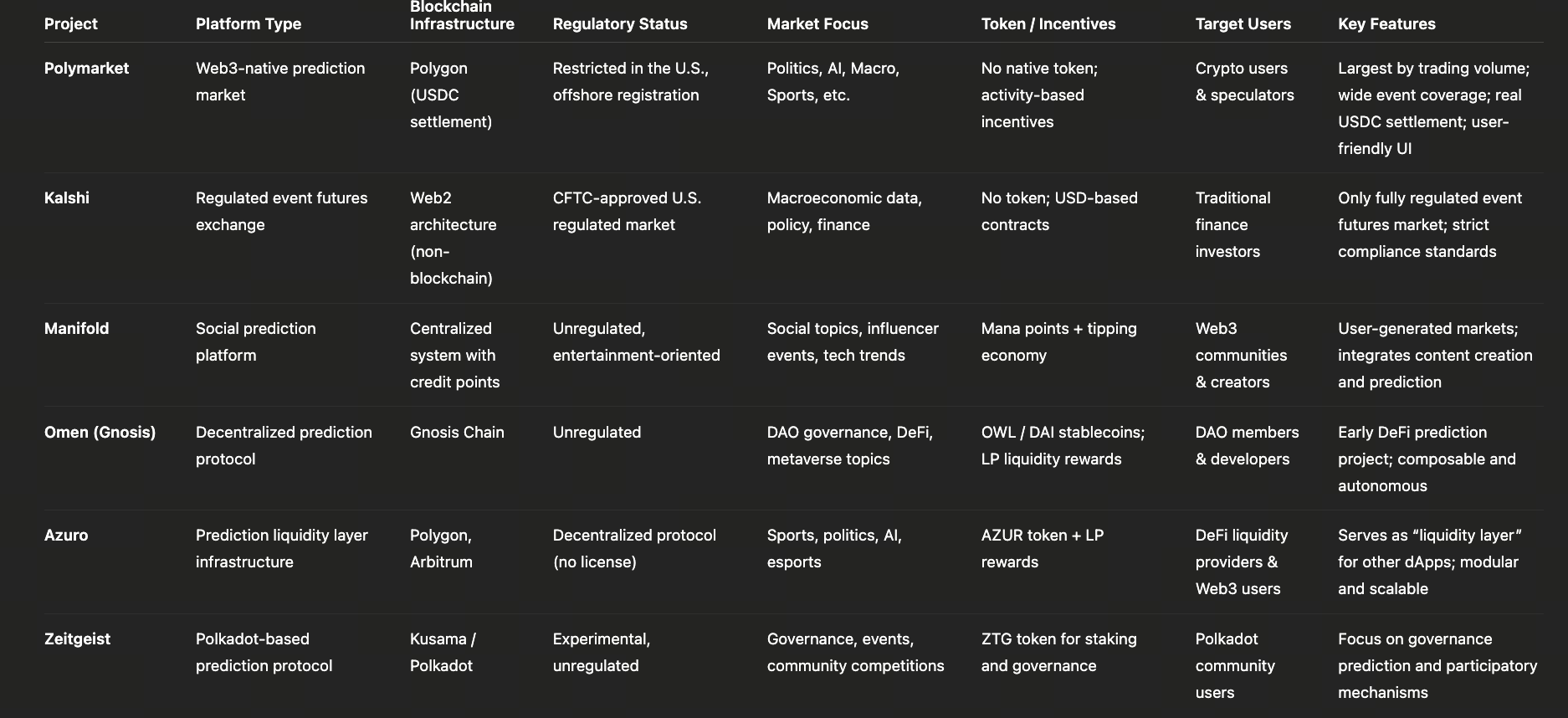

Comparative Analysis and Future Trends: Kalshi, Manifold, Omen, and Others

Besides Polymarket, several projects in the prediction market field have their own characteristics and differences. Kalshi is a fully compliant US-based platform: it has obtained CFTC approval and can operate in all 50 states. Unlike most on-chain platforms, Kalshi only accepts USD transactions, and users actually buy and sell “event contracts” settled by the exchange. Kalshi’s contract form is still mainly based on “yes/no” binary options, covering a wide range of topics from economic indicators (inflation, employment data) to elections, sports, and cryptocurrency prices. The platform is backed by top VCs like Sequoia Capital and Paradigm, with total funding exceeding $260 million and a valuation of $2 billion. It also has advisors like former CFTC nominee Brian Quintenz and Donald Trump Jr., providing support for its compliance and market expansion. The main differences between Kalshi and Polymarket lie in compliance and user groups: Kalshi focuses on institutional and US retail markets with concentrated liquidity, while Polymarket operates on-chain, leaning more towards global users and decentralized ecosystems, with the potential expectation of issuing tokens being another difference.

Manifold Markets (formerly Manifold.xyz) takes a completely different path. It is a social prediction game platform where users predict using a simulated currency called “Mana”. Early on, Manifold supported a real-money “Sweepcash” mechanism, which was discontinued in March 2025. The platform uses a Uniswap-style AMM (called “Maniswap”) to provide liquidity for markets, allowing trading even without large capital investments. Manifold focuses on community and scientific research atmosphere, often hosting offline prediction conferences, attracting prediction field experts like Nate Silver and Robin Hanson to participate. Therefore, Manifold is more of a product that combines academic research and entertainment, with its betting not involving real returns, and user experience closer to “mass guessing”, not relying on legal regulation or massive capital.

Omen, developed by the Gnosis team based on the Conditional Tokens framework, is a fully decentralized, multi-chain prediction platform. Omen allows the creation of multi-outcome markets (not limited to binary) and provides hedging contracts, with liquidity provided by an automated market-making mechanism (similar to Balancer’s constant function market-making). Omen itself does not charge transaction fees and is fully executed by smart contracts without permission. It runs on Ethereum-compatible chains like Gnosis Chain (formerly xDai), with users betting using stablecoins or local crypto assets. Unlike the above projects, Omen doesn’t have its own platform token (users mainly use ETH, DAI, OWL, etc. as collateral), and its advantage lies in its underlying security, reliability, and open permissions, allowing anyone to build prediction applications on its framework. Manifold and Omen represent decentralized and community-driven prediction market paradigms, forming a stark contrast to the professional financial attributes of Polymarket/Kalshi.

Looking ahead, prediction markets are expected to deeply integrate with narratives such as AI, governance, and DeFi. On one hand, artificial intelligence technology can improve the efficiency of prediction markets: AI agents can analyze news and data in real-time, automatically identify false information, and adjust odds; conversely, prediction market data can also provide real-time social sentiment indicators for AI models, used for macro decision-making or risk management. On the other hand, more projects may achieve community self-governance through DAO governance. For example, if Polymarket issues tokens, token holders may participate in platform decisions such as market creation, transaction fee setting, and dispute resolution. In the future, there may even be models combining AI smart contracts with DAOs, allowing AI bots to automatically adjust liquidity parameters or configure risk funds based on market needs. At the DeFi level, prediction market contracts themselves can serve as new financial derivatives: exchanges and investors can package prediction contracts into indices or hedging portfolios, and even innovative products like “oracle vaults” and “prediction options” may emerge, further expanding the DeFi ecosystem. As industry analysis suggests, the future of prediction markets depends on whether they can integrate into institutional-grade tools, achieve compliant governance, and improve accuracy using AI. If these conditions are met, prediction markets have the potential to become mainstream financial infrastructure, serving investment decision-making and public policy formulation.

Conclusion

Prediction markets are at a new development window. Polymarket’s popularity benefits from both political and technological trends, and also demonstrates the powerful potential of collective wisdom pricing mechanisms. Ordinary users participating at this time can not only earn trading profits but may also share in the benefits of upcoming airdrops based on their activity levels. Paying attention to the dynamics of platforms like Polymarket, Azuro, and Zeitgeist, actively participating in market trading and community activities will provide opportunities to stand at the forefront of this prediction market wave, while also cautiously managing risks. Whether prediction markets can become truly mainstream financial tools in the future depends on the evolution of the regulatory environment, the improvement of governance models, and the advancement of technological innovation, but what is certain is that they have already provided a new “economic experimental field” for information dissemination and decision-making.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Top 10 NFT Data Platforms Overview

Sui: How are users leveraging its speed, security, & scalability?

7 Analysis Tools for Understanding NFTs