What is the key to the rise of the crypto fundraising platform Building?

From late last year into this year, the long-dormant ICO market has experienced a resurgence. With the approval of the Bitcoin ETF, crypto-friendly policies from the Trump administration, and the momentum of a new bull market, public token sale platforms have once again become focal points for project teams, retail participants, and investors alike.

During this new cycle, CoinList—the former ICO leader—has gradually faded, giving way to the rapid ascent of new platforms such as Buidlpad, Echo, and LEGION. Take Buidlpad as an example: in just one year since its launch, it has helped four projects complete public sales, all of which were listed on Binance spot markets. Participants have seen returns as high as nearly 10x, effectively establishing Buidlpad as the new sector leader, supplanting CoinList.

This article by ChainCatcher provides a detailed analysis of Buidlpad’s development and the factors behind its rise, featuring interviews with several experienced public sale platform participants to explore from multiple perspectives: why Buidlpad?

Filling CoinList’s Gap

@ PandaZeng1, a long-time user of multiple Launchpad platforms, has systematically observed the ICO/IDO/IEO landscape. He notes that while most platforms operate similarly, the key differentiator is the performance of their earliest projects. If the first or second project fails, it creates lasting negative effects and discourages future participation.

He attributes CoinList’s decline in part to poor user experience: for users in Asia, the platform requires waiting in line, and the time zone is set to the US, forcing Asian users to stay up late for a chance to participate—often unsuccessfully. Although CoinList later introduced a Karma points system (requiring users to trade or swap on the platform to earn points), this failed to stem user attrition.

By contrast, the success of new platforms like Echo and Buidlpad is rooted in the strong performance of their early projects, which quickly built their reputations. For example, Echo’s Sonar debuted Plasma, setting user expectations. He emphasizes that the crypto market is driven by expectations: in rational periods, it’s valuation-driven; in irrational periods, it’s dream-driven. Ultimately, it comes down to the “dream-to-reality ratio.”

@ 0xhahahaha echoes these observations, pointing to the breakdown of the wealth effect as a vicious cycle. Having participated in five or six CoinList presales, she notes that the core problem is the declining quality of projects offered. Some less popular projects fail to list on major exchanges (like Binance or Coinbase), only appearing on smaller venues with weak liquidity, no buy-side demand, only sell orders, and restrictive sale conditions—sometimes requiring a one-year lockup. Even with immediate TGE, profits are not guaranteed.

Between 2023 and 2024, most tokens launched on CoinList saw significant price drops after listing, typically falling 70%–98%. Examples include ARCH (-98%), FLIP (-73%), ZKL (-93%), and NIBI (-78%), with most FDVs dropping below $100 million.

Filecoin’s success in 2017 established CoinList’s reputation for “high returns.” However, as investors hoped for repeated success, shifting market cycles, regulatory changes, and evolving user needs made this unsustainable.

Today, unresolved issues—such as poor platform experience, declining project quality, and low returns, which matter most to participants—have amplified community dissatisfaction and accelerated user loss. This has paved the way for platforms like Echo, LEGION, MetaDAO, and Buidlpad to fill the vacuum left by CoinList’s decline.

Blockbuster Performance

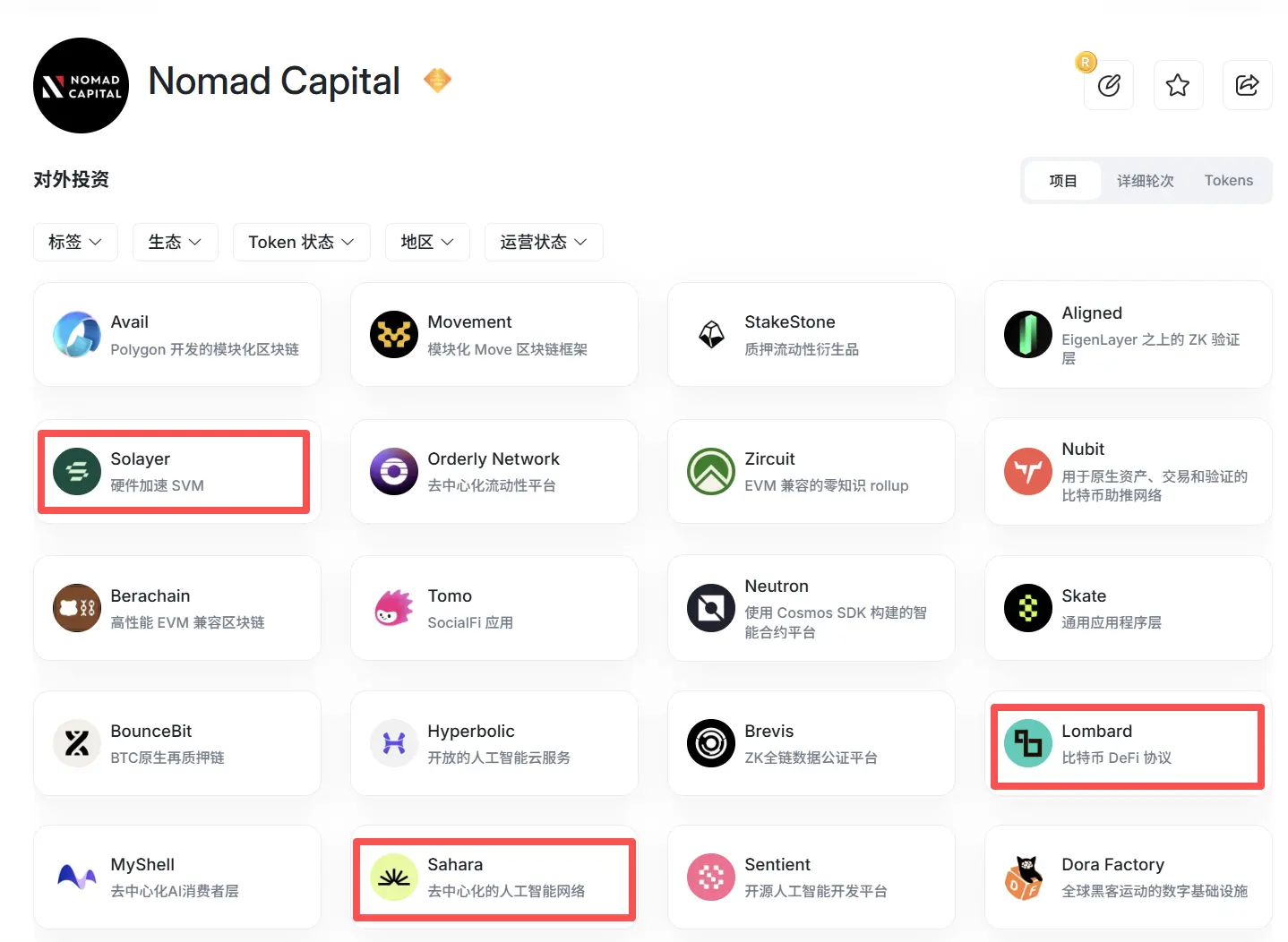

Buidlpad, for example, has helped Solayer, Sahara AI, Lombard Finance, and Falcon Finance complete public sales and list on Binance spot. Looking at Buidlpad’s track record, its first project, Solayer, was offered at a $350 million valuation with a token price of $0.35, peaking at $3.43—delivering an investment return of nearly 9.77x for early participants. Sahara AI raised at a $600 million valuation, with a token cost of $0.06 and a peak price of $0.15, achieving a 2.68x return, 8.8x oversubscription, and $75 million in total subscriptions.

@ 0xhahahaha began using Buidlpad because of Falcon Finance, following the common strategy of “go where the money is.” She attributes Buidlpad’s success to its rigorous project selection—every project ultimately listed on major exchanges (like Binance spot), creating a reliable wealth effect that attracted users migrating from CoinList.

For Buidlpad’s rise, @ PandaZeng1 highlights several key factors: Buidlpad selects projects with relatively high valuations, and those that go live are essentially grand slams, listing on Binance, Upbit, and more. The platform excels at helping users capture value, with most projects offering 2–10x return potential. Compared to Echo, Buidlpad is less restrictive, making it easier for retail investors to participate.

Buidlpad has developed its own narrative and selection standards for project vetting, quality control, and distribution mechanisms. In addition to comprehensive due diligence and business model assessment, Buidlpad employs anti-sybil measures such as KYC verification, compliance checks, and security protocols to prevent fake accounts and mass studio participation, ensuring fair token allocation.

As of September 2025, the platform has secured over $320 million in subscription commitments across its first four events, attracting more than 30,000 verified users. Its latest project, Momentum Finance, launched a public sale in October, targeting a $4.5 million raise.

Buidlpad has also introduced the Squad system, which rewards participants for content creation in addition to the existing staking model. This approach helps projects build communities early and encourages participants to contribute beyond capital.

With all Buidlpad-issued projects now listed on Binance spot, the platform has become the launchpad of choice for projects seeking listings on Binance and other major exchanges—a success closely tied to founder Erick Zhang’s background.

Binance-Linked Background

According to Erick Zhang’s LinkedIn profile, he holds a master’s degree from Carnegie Mellon University and a bachelor’s from the University of Macau. His early career details are limited, but he served as Vice President at Citibank from 2013 to 2015. Shortly after Binance was founded, he joined as a senior executive, demonstrating keen industry insight.

While at Binance, he led Binance Research and Binance Launchpad, gaining extensive experience in project research and selection, and helped establish the token listing framework. Under his leadership, Binance Launchpad assisted over 20 projects in completing ICOs, raising more than $100 million. These included industry leaders like Polygon and Axie Infinity. The wealth effect of Launchpad tokens made Binance Launchpad an industry benchmark. He later became CEO of Binance-owned CoinMarketCap, moving from vertical business leader to independent business head.

After building expertise in data analysis, team management, and industry networks, Erick Zhang left Binance in December 2022 to found Nomad Capital. A few months later, Binance Labs invested in Nomad Capital, maintaining close ties. At the end of last year, Erick launched Buidlpad.

Notably, three of the four projects launched on Buidlpad to date have received investment from Nomad Capital. Once listed on Binance spot, these projects also generated significant returns for Binance Labs, the primary LP of Nomad Capital.

Buidlpad’s close ties with the Binance ecosystem are clearly one of the most critical factors behind its success. The market tailwinds left by CoinList’s decline and Buidlpad’s unique project selection process have also paved the way for its ascent.

With Buidlpad’s main competitor Echo recently acquired by Coinbase, token fundraising platforms are becoming the new battleground for primary market pricing power. The decline of CoinList and the rise of Buidlpad and Echo reflect the changing structure of ICOs. As short-term speculation cools, public token sales are bridging the gap between user demand and platform mechanisms.

These platforms serve as essential channels for projects to gain early users and initial liquidity, while also cementing their status as top destinations for investors seeking early-stage opportunities. Even during prolonged bear markets, these investment opportunities remain highly attractive.

Disclaimer:

- This article is republished from [ChainCatcher]. Copyright belongs to the original author [Chloe, ChainCatcher]. If you have any objections to this republication, please contact the Gate Learn team, and we will address your concerns promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is mentioned, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?